Financial literacy and money management are not always part of the school curriculum and most young people graduate without a basic knowledge of how to plan for their financial lives. Most children and teens learn basic money management tricks from their parents or guardians but without a structured approach to managing money, many will struggle to make effective financial decisions. This lack of formal education around financial well-being has led to an adult population of people who are not in a secure financial position. According to a Federal Reserve Board survey, nearly half of all American adults would struggle to find $400 to cover an emergency.

In response to the issues around financial literacy, many services and banking solutions have emerged to encourage financial education from a young age. Solutions include the adult/child or junior accounts.

What is an adult/child account?

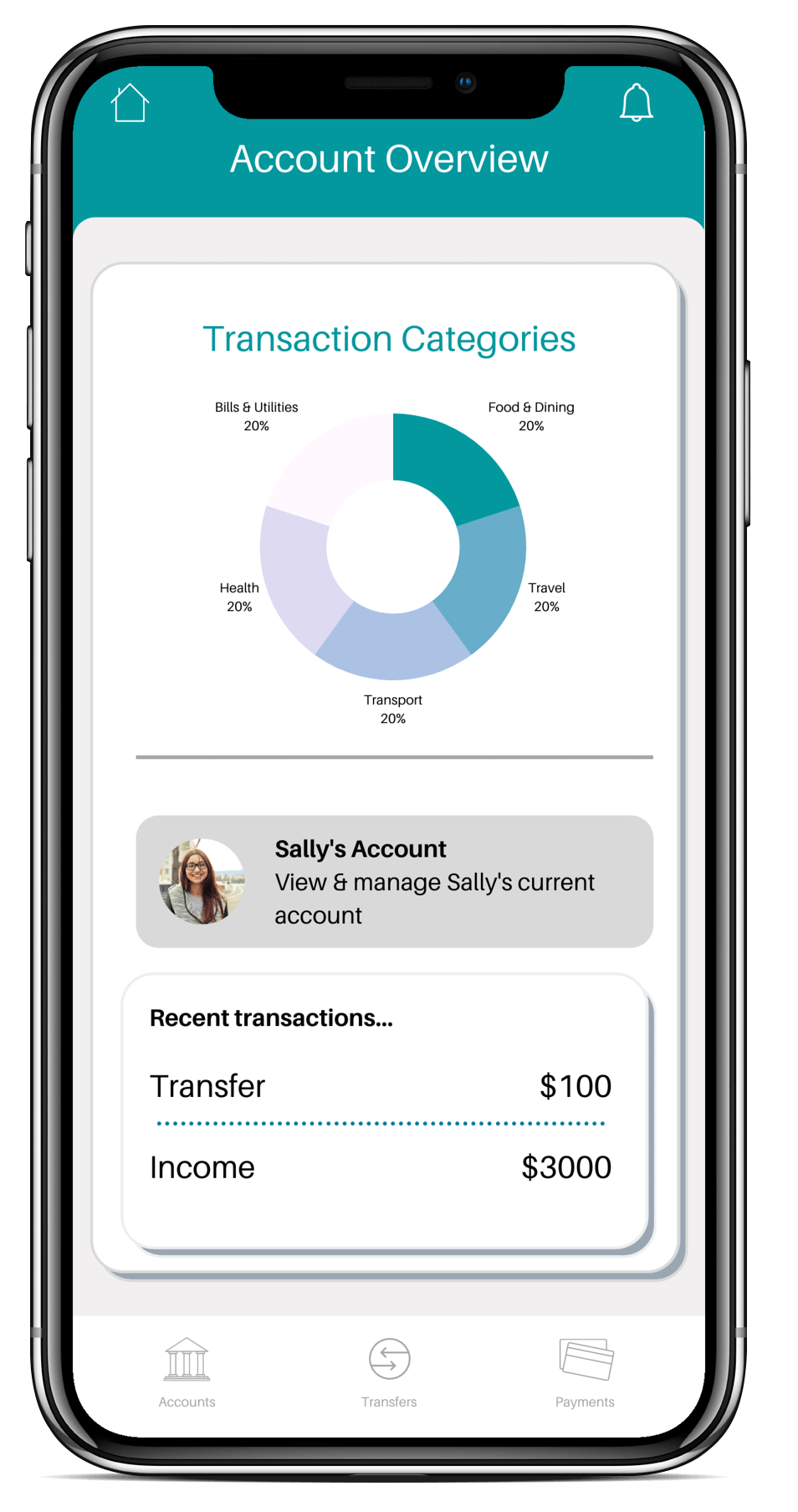

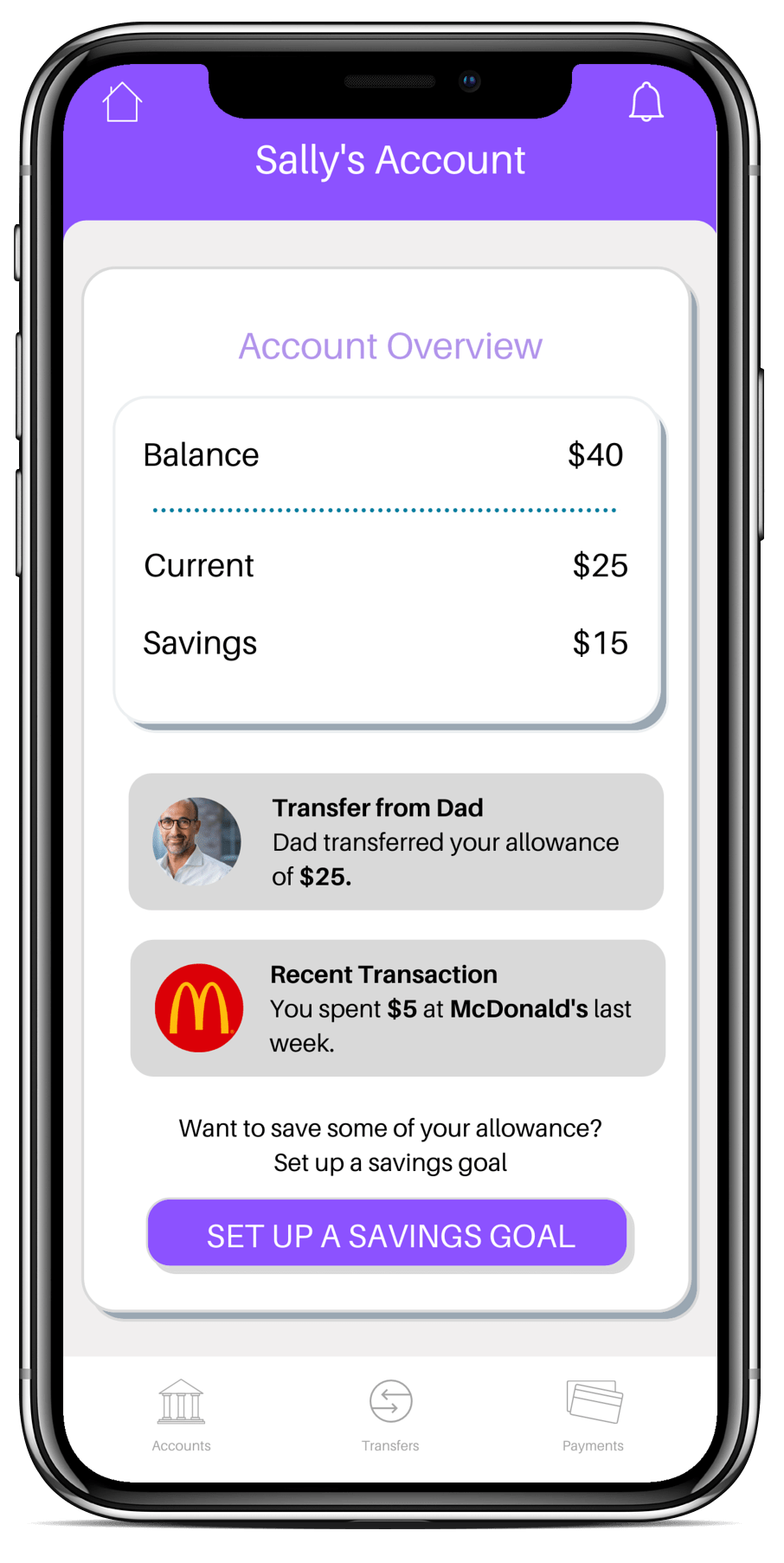

The adult/child or junior account is one that is controlled by the parent but gives children the responsibility of managing their own finances and setting them up with good financial management behaviours from a young age.

The child account acts a sub- or joint account of the parent’s account, where the parent can oversee and track their child’s expenses and savings. It will ideally provide children and teens with insights and recommendations on their spending and give them the tools to set up budgets and savings goals.

.

.

What are the benefits of setting up an adult/child account?

- Control of finances

Parents or guardians can transfer money to the child account when needed and set up various controls around how and where money is spent.

- Financial Literacy

A parent/child account can be used as a way to teach children and teens how to manage finances correctly. Gamification and incentives can be used to educate them on concepts like savings, investing and even interest rates.

- Security & Safety

The parent account has full control over the child account and can cancel cards and block payments when needed, so they don’t need to worry if their child’s card is stolen or lost.

Why should banks offer an adult/child account?

- Increased loyalty amongst adult account holders

By offering this service you can increase the stickiness of your adult account holders. Having a sub-account set up with regular notifications about the child account activity will keep your adult customers engaged and reduce the likelihood of them switching to a competing bank where this service is not offered.

- Financially literate customers are more profitable

Research has proven that financially literate customers are likely to purchase more financial products and services than their financially illiterate counterparts. They are also shown to be more profitable customers too. Educating customers from a young age will create a generation of people who are engaged in financial management and who are keen to buy relevant financial products and services for them.

- Potential new market of customers

Those on child/junior accounts are likely to stay as customers when they graduate to their own adult account. Although bank switching has in recent years increased, the old thinking that your first bank is your bank for life does in some respects still ring true. By offering child and teen accounts you are building awareness of you brand from a young age, even before they start to think about which bank to choose.

Moneythor is working with a number of clients to provide money management capabilities with personalised recommendations, insights and nudges based on data from both the adult and child accounts. If you are interested in finding out more about how you could use Moneythor to create a personalised and data-driven adult/child account service, contact us here.