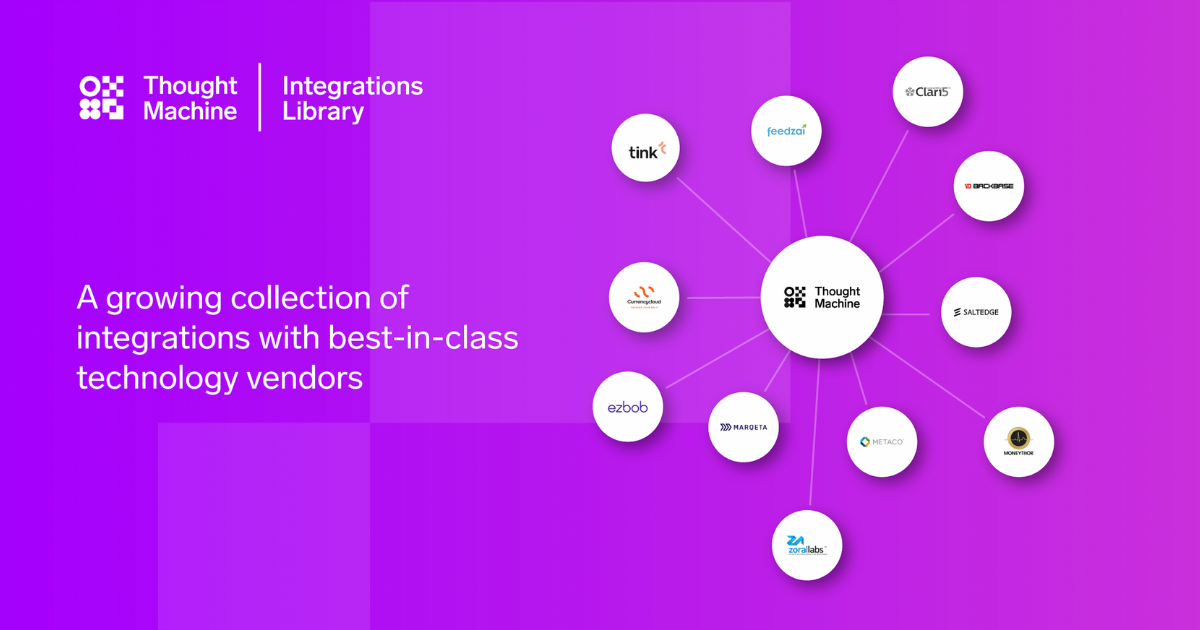

Thought Machine, the modern core banking technology company, launches their Integration Library today, and we are proud to have been selected in the first group of partners across the banking and fintech domains to be featured in this launch.

The Integration Library features a set of curated integrations that are interoperable with Vault Core, and is fully documented and validated. Vault Core’s joint solution with Moneythor delivers enhanced digital insights, recommendations and nudges for banks’ customers, utilising Vault Core’s real-time data feed to deliver categorised spending, financial management advice and goal setting capabilities among other user cases.

“Vault Core is a highly configurable platform which, through industry-standard APIs, easily connects and plugs into an ecosystem of technology vendors, allowing banks to build a best-in-class technology stack. In the past, clients would have had to undergo a comprehensive vendor selection process and build out integrations for each of their selected vendors, a costly and resource-intensive task.

Today, this challenge is now drastically simplified and reduced with our Integration Library – a curated collection of technology vendor integrations, interoperable with our core banking platform Vault Core, built either by us, or by best-in-class partners. The library makes it both easier and faster to select and build integrations to the other vendors needed around Vault Core.” – Bradley Steele, GM North America and Global MD Partnerships, Thought Machine.

Vault Core’s Universal Product Engine coupled with Moneythor’s unique solution delivers fully configurable, personalised, data-driven money management insights to consumers in real time, thus giving banks and fintech firms the ability to anticipate and respond to their customers’ continuously evolving financial needs while driving more personalised engagement and stickiness within their digital services.

Utilising Vault Core’s real-time data feed, banks can now provide data-driven personalisation to their customers, along with categorised spending & income details enriched with contextual and actionable financial wellbeing features powered by the Moneythor platform.