As we approach 2024, digital banking is set for substantial changes, influenced by emerging trends that are reshaping the financial landscape. In the past year, global dynamics have given rise to compelling themes that are gaining prominence. In this fast-evolving environment, the traditional concerns of fraud and scam prevention have taken on new dimensions, involving not only cybersecurity teams but also marketing, product, and customer experience departments.

At the same time, the focus on customer activation has grown, with 2024 seen as a year where this term becomes crucial for the success of digital banking ventures. Additionally, the integration of gamification techniques into banking experiences has evolved from a regional trend to a global necessity.

In this article, we explore these trends and their pivotal role in shaping the digital banking landscape in the coming year.

Customer Activation

For 2024, we predict that “activation” will take centre stage as one of the keywords of the year in digital banking. This year has already witnessed an increasing emphasis on activating banking customers, with both traditional banks and emerging digital players grappling with the challenge of ensuring that acquired customers translate into profitability.

Earlier this year, we conducted in-depth research on activation and explored the associated challenges and opportunities.

Access the detailed report here

This exploration gave rise to the concept of Customer Activation Management (CAM), the strategic and process-driven approach to ensuring banking customer become activated and engaged users of truly personalised banking experiences.

To learn more about CAM, check out our guide here.

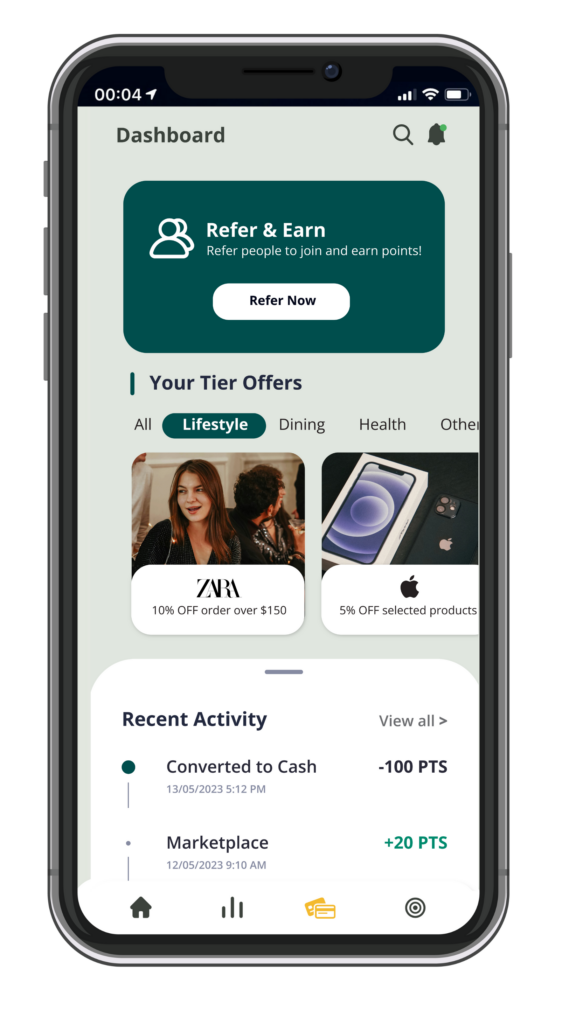

Gamification

At Moneythor, we have been developing capabilities and enabled experiences that blend loyalty and gamification techniques into digital banking journeys for several years. We’ve witnessed measurable results, such as increased engagement and activation, that these programs have delivered for many of our clients in Asia.

In 2023, we observed a growing demand across continents, with an expanding interest in these techniques in the Middle East and Africa, Europe, and the Americas. We anticipate that financial institutions worldwide will increasingly tap into gamified loyalty techniques in 2024, not just in their traditional card/spend programs, but also to power more rewarding savings/deposit journeys, as well as to enhance their Personal Financial Management (PFM) and financial wellness programs.

Fraud and Scam Prevention

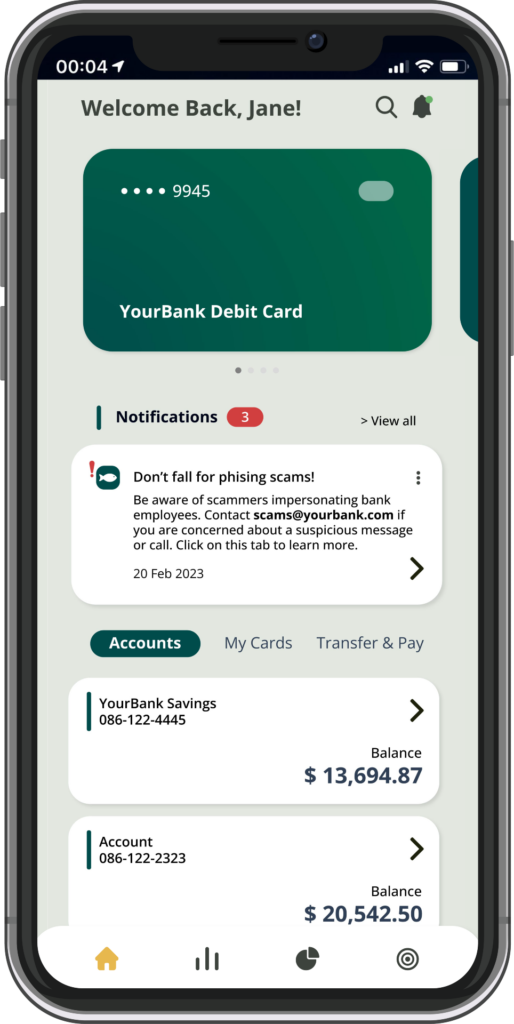

Although a persistent concern for several years, online fraud and scams have reached unprecedented levels worldwide. Notably, the responsibility for preventing them has expanded beyond CISO teams, now involving marketing, product, and customer experience teams at financial institutions of all sizes, often under the active guidance of regulators.

It is evident that effective fraud and scam prevention significantly relies on educating customers to detect, avoid, and report attempted or successful occurrences. In response, leading financial institutions have sought to implement personalised, actionable, and, in a growing number of cases, gamified educational experiences focused on prevention.

Conclusion

Looking ahead to 2024, the digital banking sector is expected to grow and innovate, with fraud and scam prevention, gamification and customer activation management all contributing to this evolution. Staying on top of these changes will be crucial for financial institutions looking to position themselves favourably in the dynamic landscape of digital banking.