The current state of play

In the midst of a cost-of-living crisis and with rising interest and mortgage rates, New Zealand customers were in need of better support and more innovative tools to help them to manage their finances. It was against this economic backdrop that the team at Booster, the leading provider of KiwiSaver superannuation and consumer-friendly invest products, launched day-to-day spending and saving account, Savvy.

About Savvy

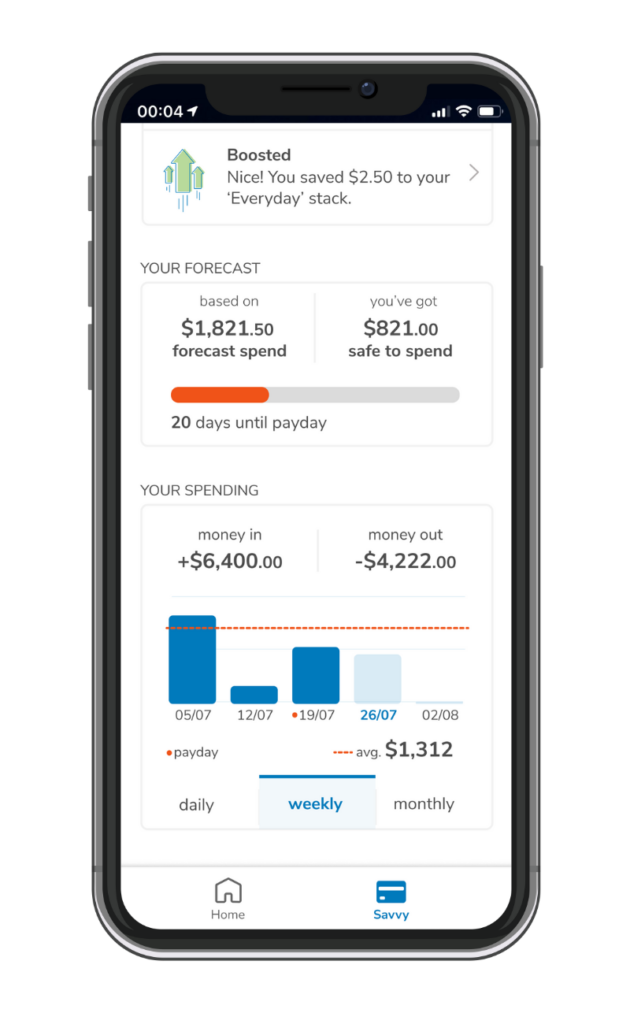

With a focus on assisting customers in better managing their finances, Savvy is a smart account and debit card that helps customers spend and save more effectively with personalised insights and savings tools.

The team at Booster noticed a gap in the market, realising that while technology is opening up so many new possibilities, our ways of saving and spending have pretty much stayed the same. And so they developed Savvy, to offer customers a fresh and powerful approach to handling their money.

Savvy accounts help customers to spend and save smarter by providing personalised insights, automated saving options, savings tools and competitive returns. Each account is tailored to the customer’s needs, forecasting, tracking, and nudging them towards better habits every day.

To bring Savvy to life, Booster deployed the Moneythor solution to deliver the real-time orchestration of interactive experiences, along with personalised and actionable recommendations, insights and nudges for its customers. The successful integration has resulted in a comprehensive set of capabilities offered in Savvy right from its launch, showcasing a level of breadth and depth rarely seen in the initial versions of other digital banks.

The following features are incorporated into Savvy:

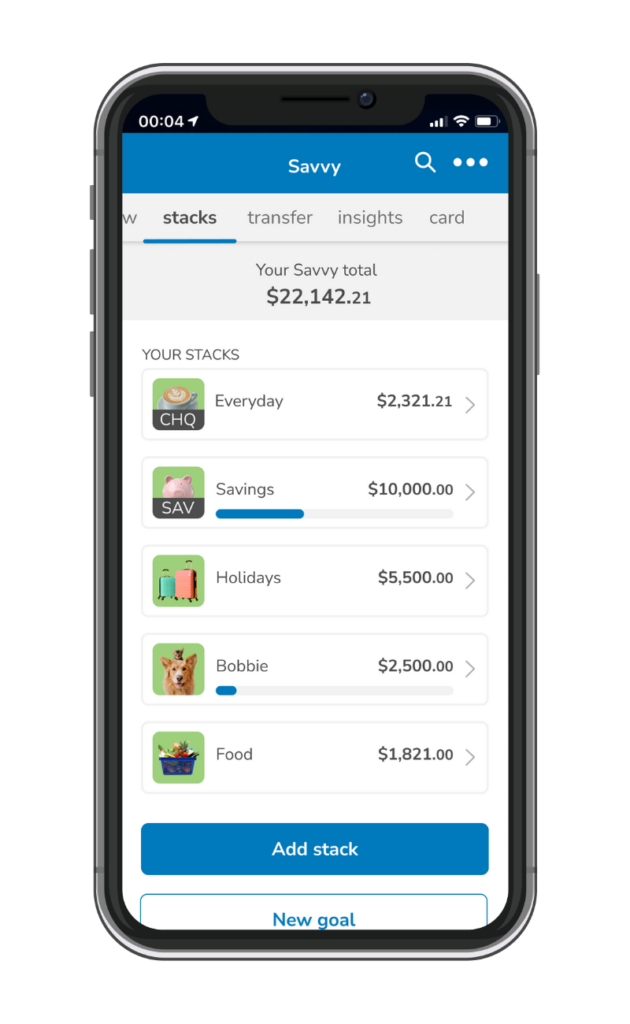

1. Stacks

Organise your finances by creating distinct stacks to separate your rent fund from your spending money, allowing you to establish personalised goals for each.

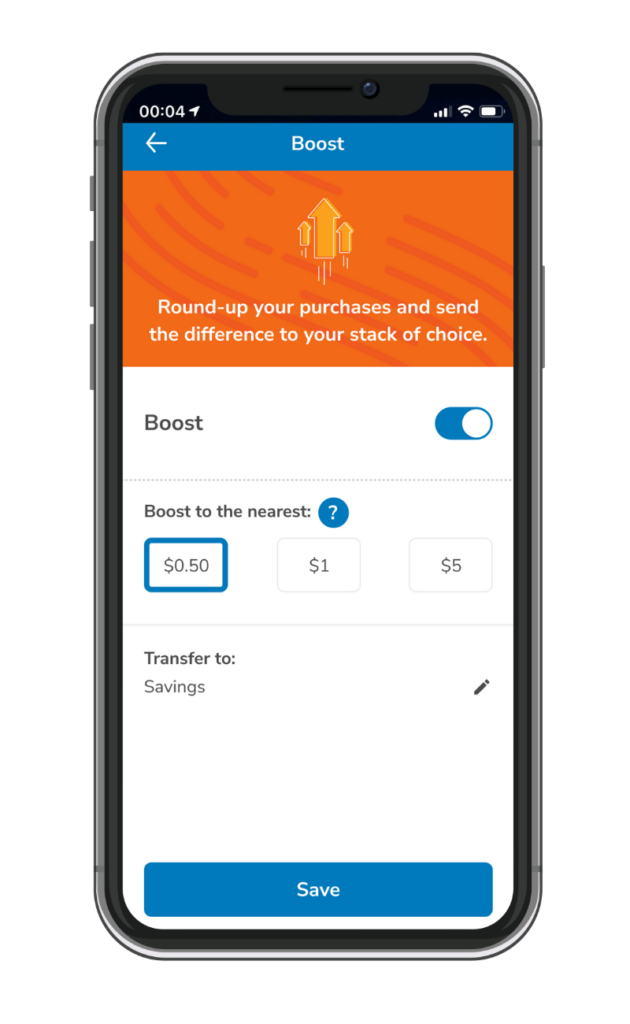

2. Boost

With Boost, every purchase made using your Savvy debit card contributes to your savings. Savvy can round up your purchases to the nearest 50 cents, $1, or $5, and transfer the difference to your chosen Stack. Each day, Savvy displays your boosted savings, providing you with a satisfying sense of your growing savings.

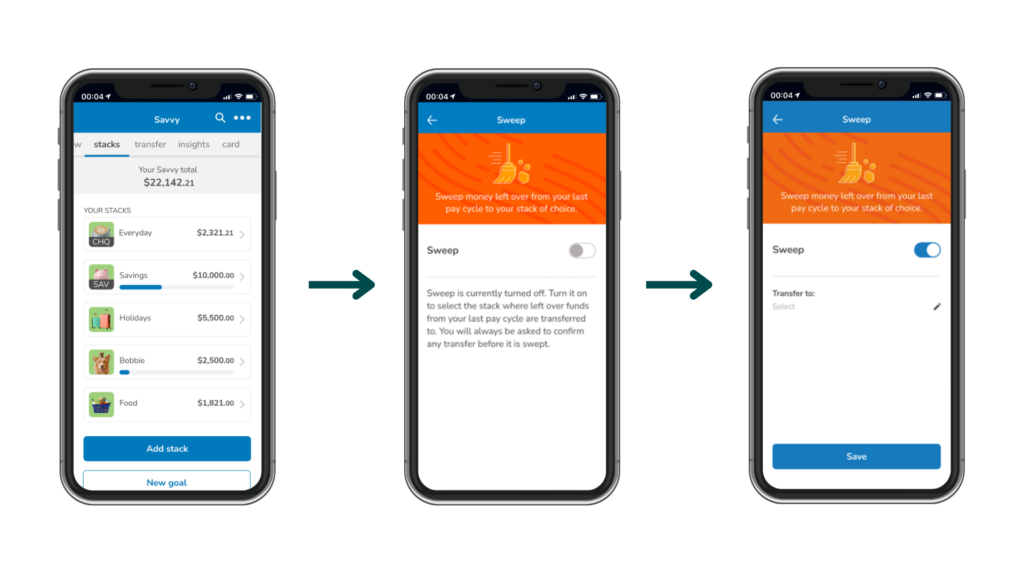

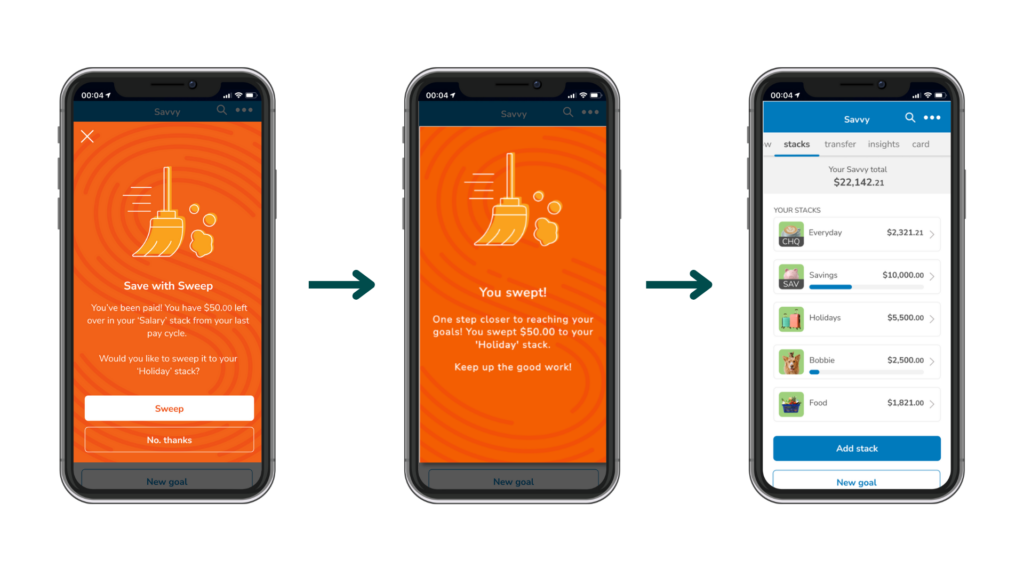

3. Sweep

If you find yourself with some remaining change just before your next payday, resist the urge to splurge and consider boosting your finances with Sweep. Savvy automatically checks your balance every payday. If there’s money left over from your previous pay cycle, Savvy can sweep it into your chosen Stack.

a) Sweep any additional funds directly into your designated Stack, getting you closer to your savings goal.

b) Each Sweep brings you closer to achieving your financial goals. Delight in the progress as your savings gradually add up.

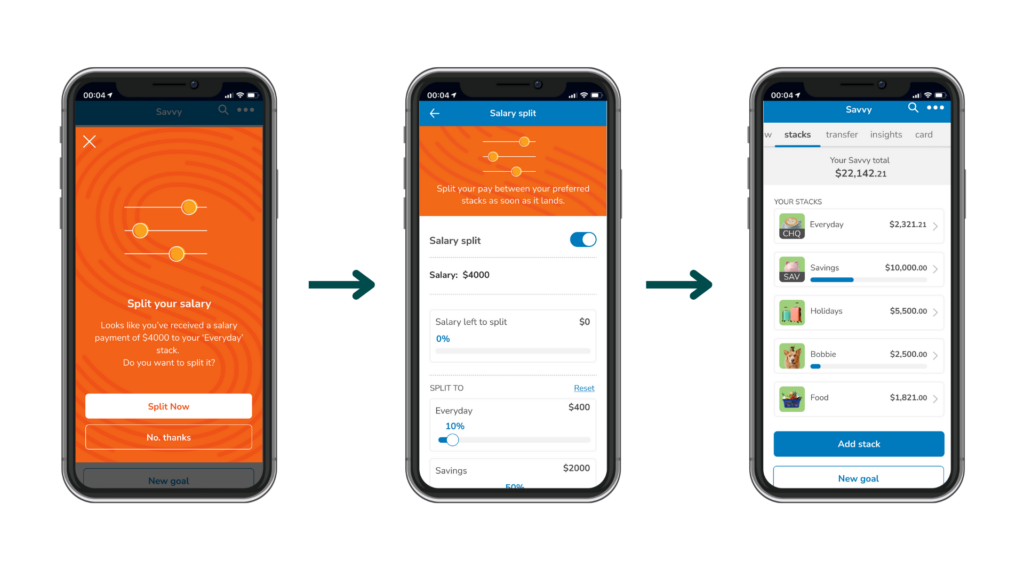

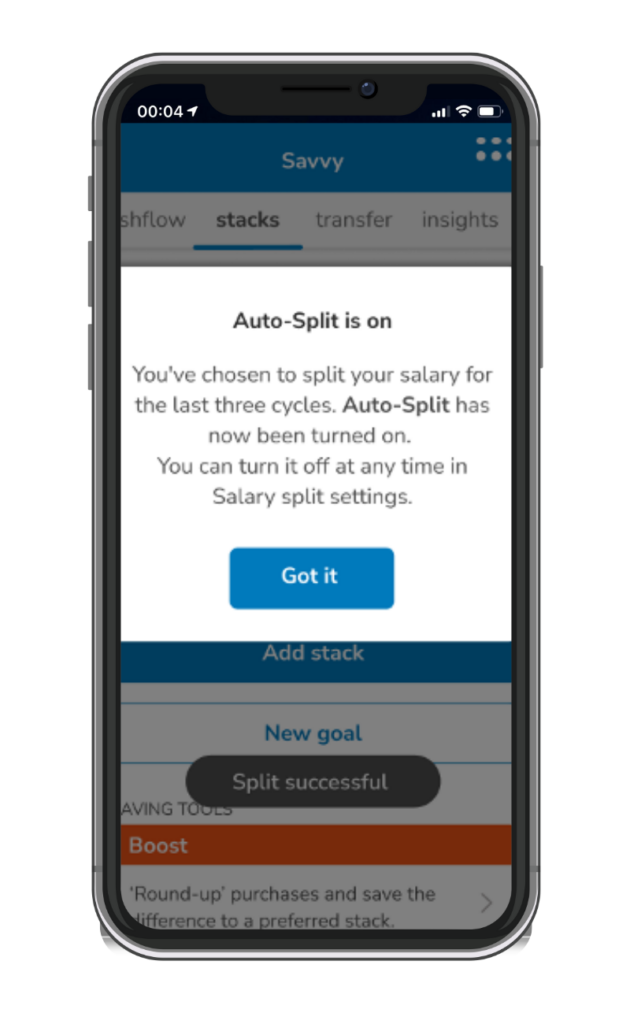

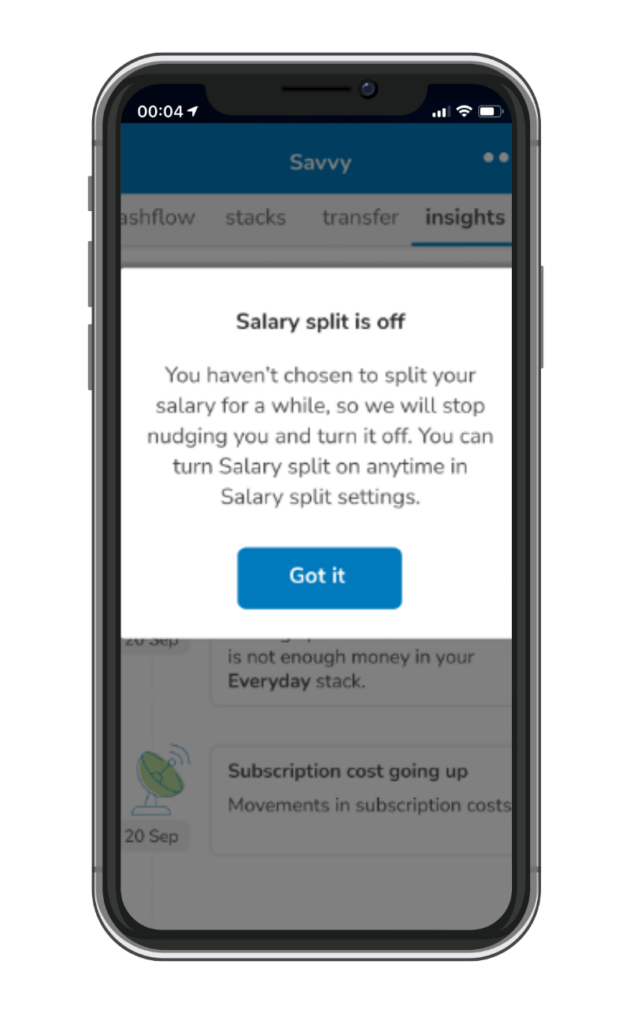

4. Salary Split

Organise your money before it arrives. Direct your pay to the appropriate Stacks the moment it lands.

a) Effortlessly allocate and transfer funds to your chosen Stack with every payday

b) Automatically split your salary and see your cash sort itself out

c) Turn on Salary split anytime in Salary split settings

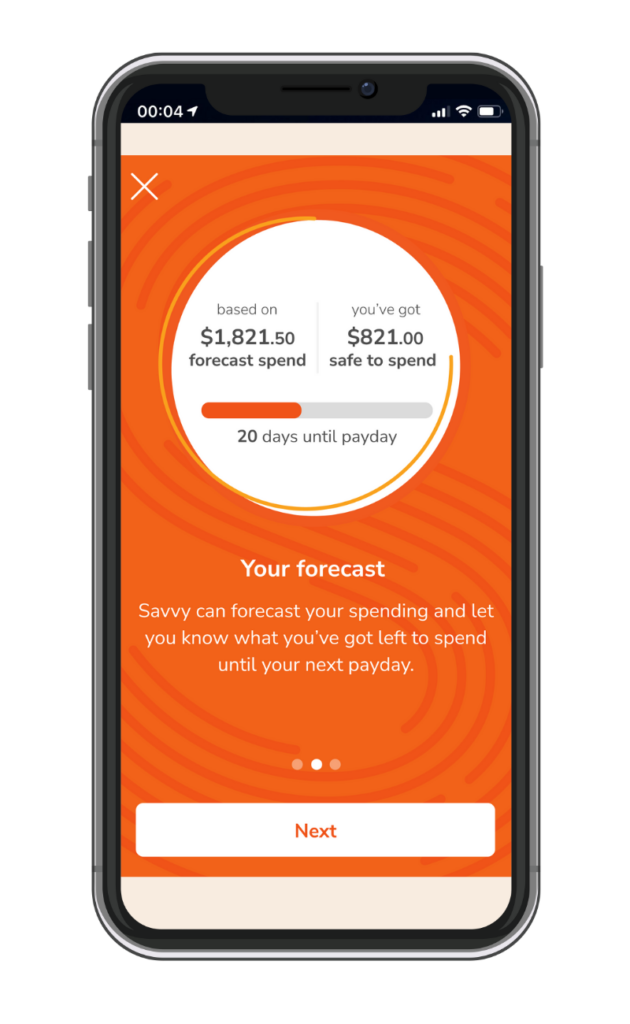

5. Forecast

Stay ahead with Savvy. It learns to predict bills and informs you of your available funds, keeping you consistently informed.

6. Cashflow

Always know where you stand. Savvy provides a snapshot of your spending habits on a daily, weekly, and monthly basis.

Conclusion

Savvy is introducing an entirely new approach to delivering digital money management to New Zealanders through a personalised and real-time engagement solution. With a truly customer-centric approach to money management, Savvy aims to assist customers in achieving their financial goals and enhancing financial well-being.