How Australian Mutuals can Enhance Financial Wellbeing for their Members

With the state of consumer wellbeing in Australia continuing to face pressure due to shifting economic conditions and environmental disruptions, it’s a smart move for Mutuals to focus on improving their members financial wellness.

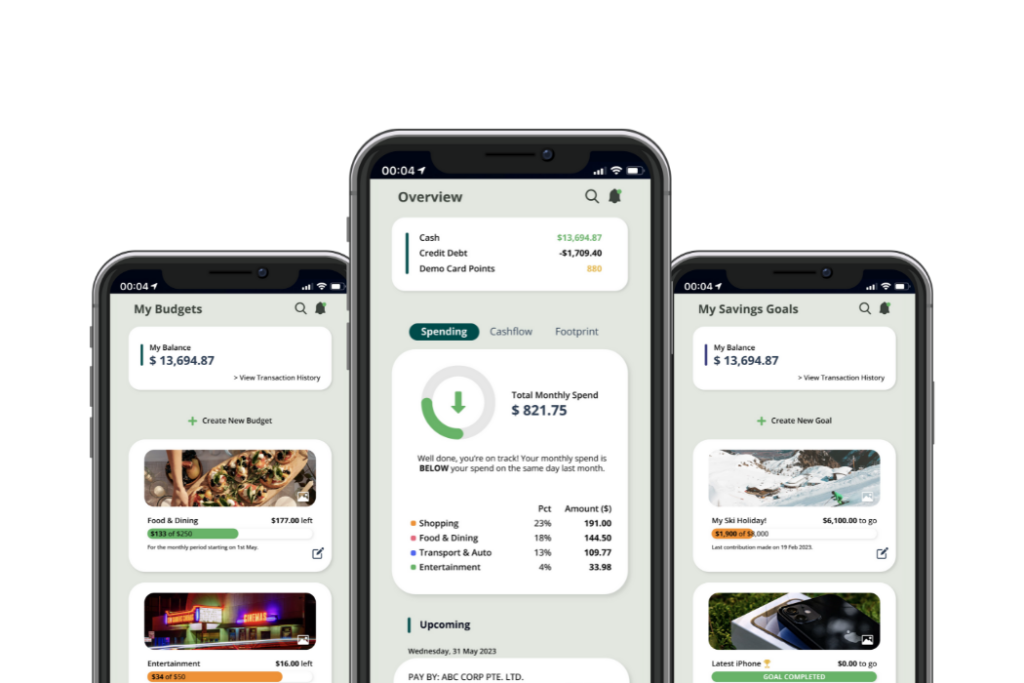

To achieve this, Mutuals can enhance their digital services with:

- Personalized insights

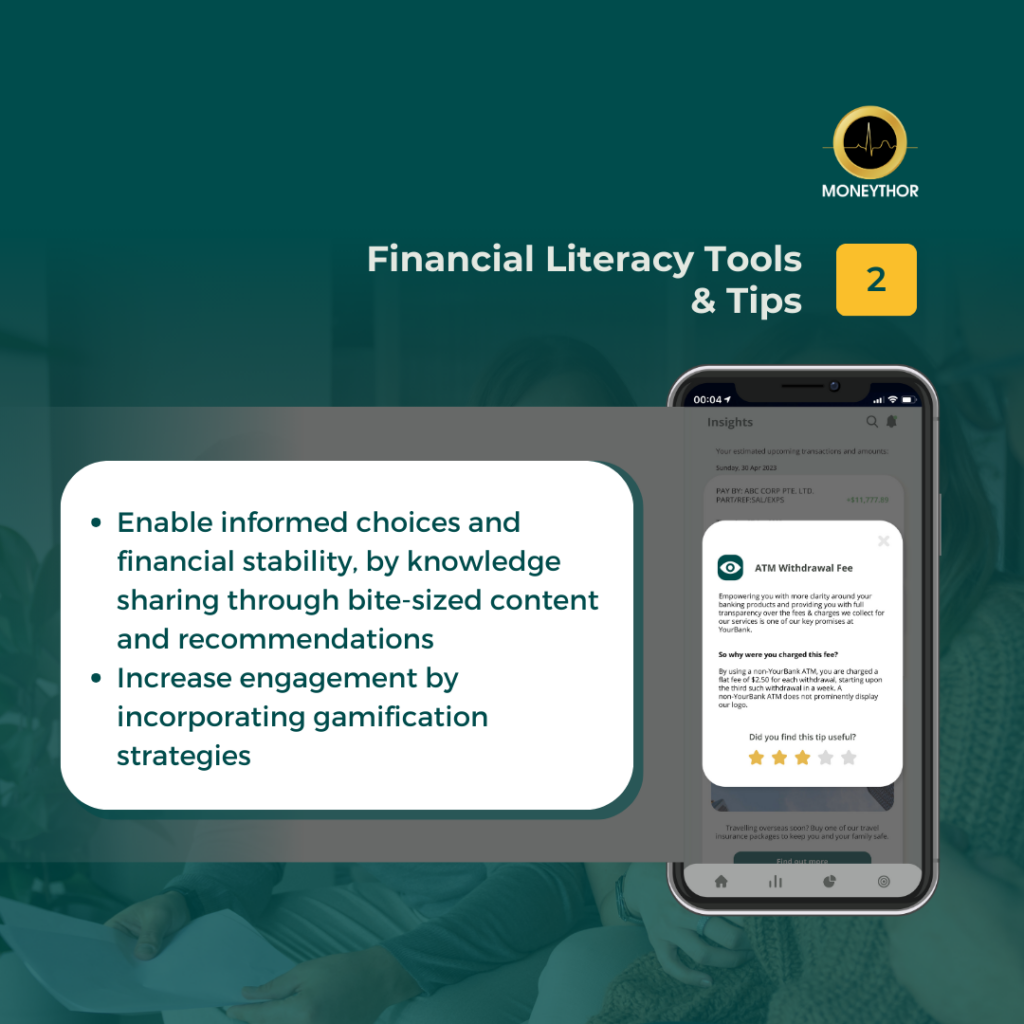

- Financial literacy resources

- Savings goals

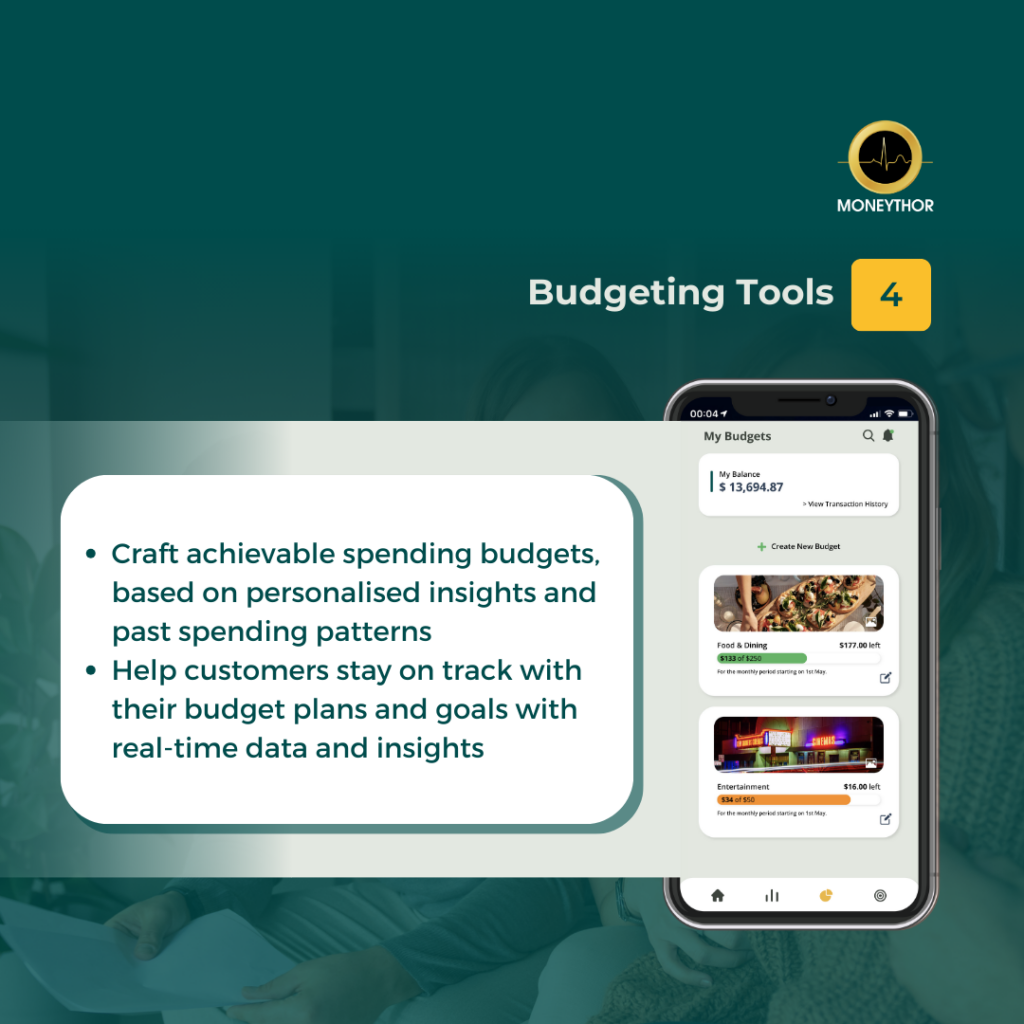

- Budgeting tools

- Predictive money management

With the state of consumer wellbeing in Australia continuing to face pressure due to shifting economic conditions and environmental disruptions, it’s a smart move for Mutuals to focus on improving their members financial wellness.

This will not only reduce your members stress, but it will also boost mental, emotional, and financial security, while enhancing retirement readiness and flexibility.

To achieve this, Mutuals can enhance their digital services with:

- Personalized insights

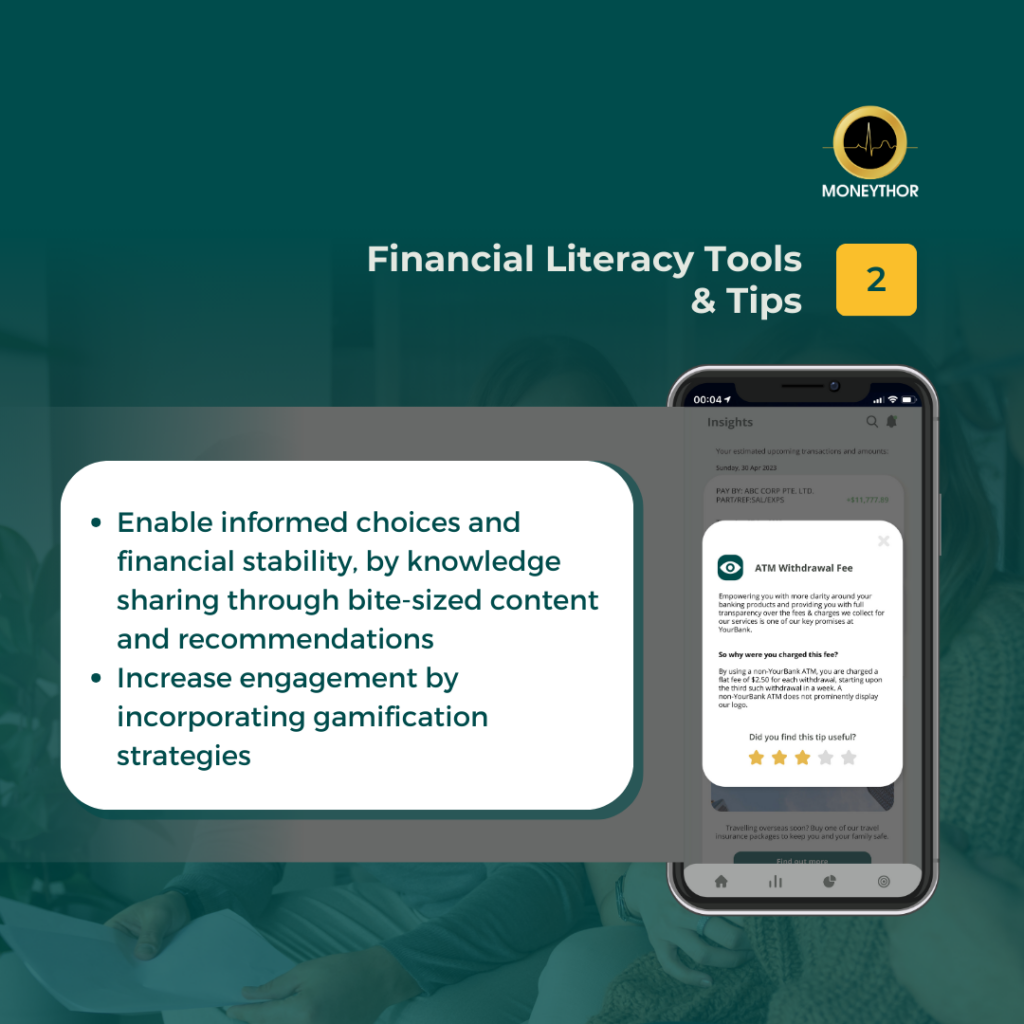

- Financial literacy resources

- Savings goals

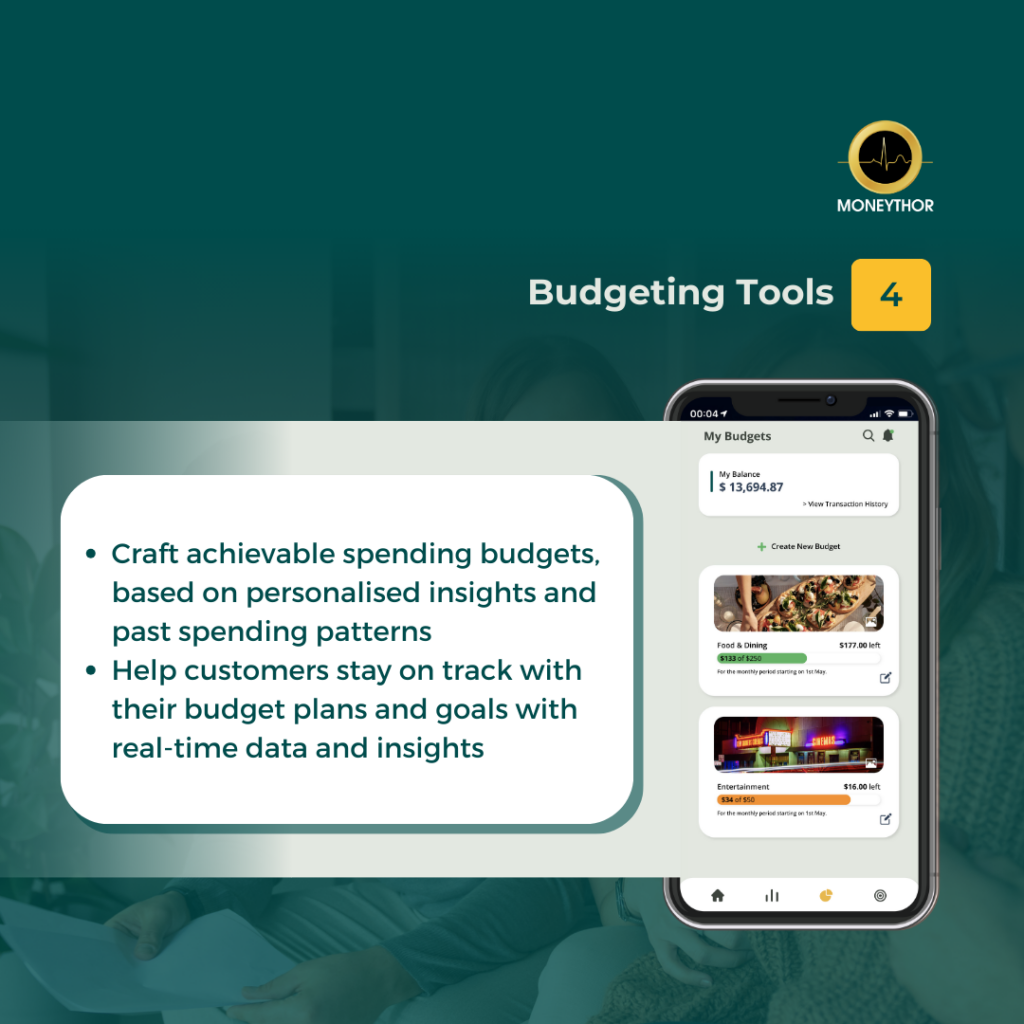

- Budgeting tools

- Predictive money management

With the state of consumer wellbeing in Australia continuing to face pressure due to shifting economic conditions and environmental disruptions, it’s a smart move for Mutuals to focus on improving their members financial wellness.

To achieve this, Mutuals can enhance their digital services with:

- Personalised insights

- Financial literacy resources

- Savings goals

- Budgeting tools

- Predictive money management

With the state of consumer wellbeing in Australia continuing to face pressure due to shifting economic conditions and environmental disruptions, it’s a smart move for Mutuals to focus on improving their members financial wellness.

To achieve this, Mutuals can enhance their digital services with:

- Personalised insights

- Financial literacy resources

- Savings goals

- Budgeting tools

- Predictive money management

With the state of consumer wellbeing in Australia continuing to face pressure due to shifting economic conditions and environmental disruptions, it’s a smart move for Mutuals to focus on improving their members financial wellness.

This will not only reduce your members stress, but it will also boost mental, emotional, and financial security, while enhancing retirement readiness and flexibility.

To achieve this, Mutuals can enhance their digital services with:

- Personalized insights

- Financial literacy resources

- Savings goals

- Budgeting tools

- Predictive money management

With the state of consumer wellbeing in Australia continuing to face pressure due to shifting economic conditions and environmental disruptions, it’s a smart move for Mutuals to focus on improving their members financial wellness.

To achieve this, Mutuals can enhance their digital services with:

- Personalized insights

- Financial literacy resources

- Savings goals

- Budgeting tools

- Predictive money management

With the state of consumer wellbeing in Australia continuing to face pressure due to shifting economic conditions and environmental disruptions, it’s a smart move for Mutuals to focus on improving their members financial wellness.

This will not only reduce your members stress, but it will also boost mental, emotional, and financial security, while enhancing retirement readiness and financial flexibility.

To achieve this, Mutuals can enhance their digital services with:

- Personalised insights

- Financial literacy resources

- Savings goals

- Budgeting tools

- Predictive money management