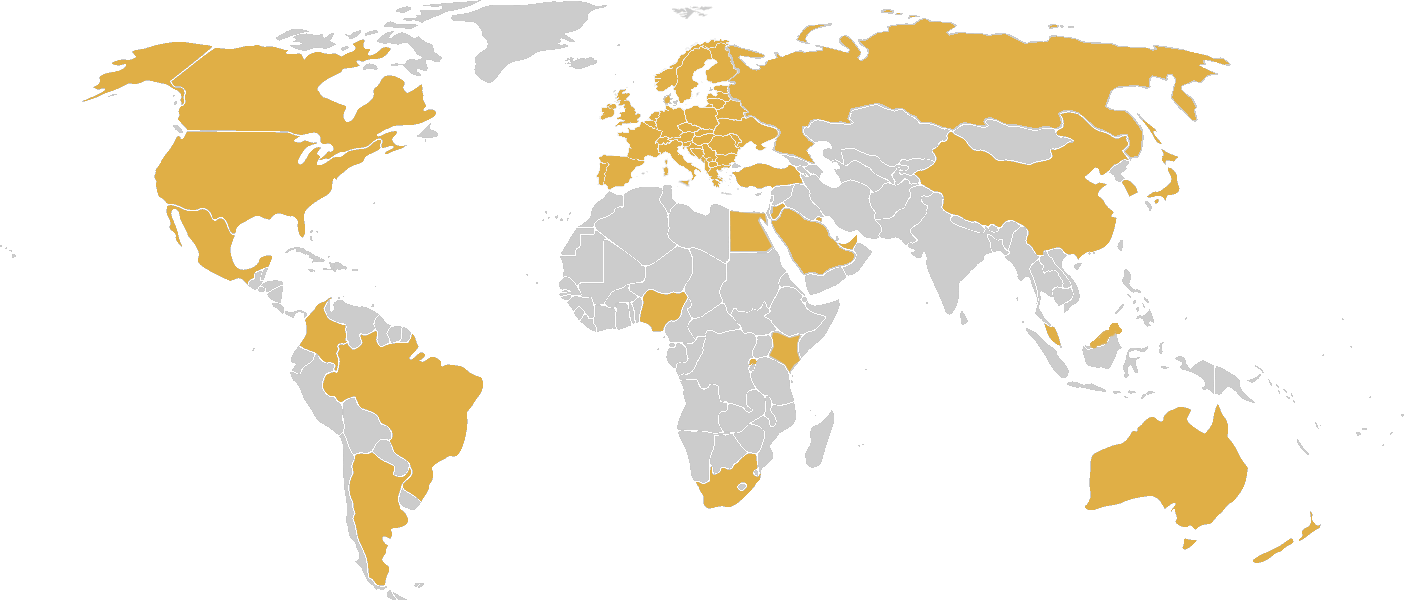

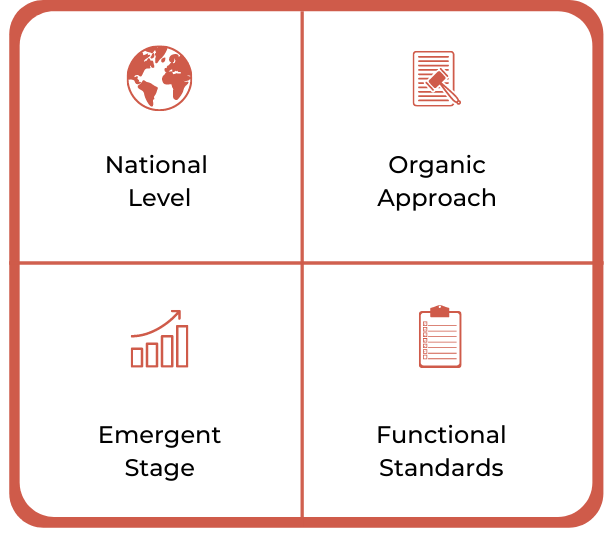

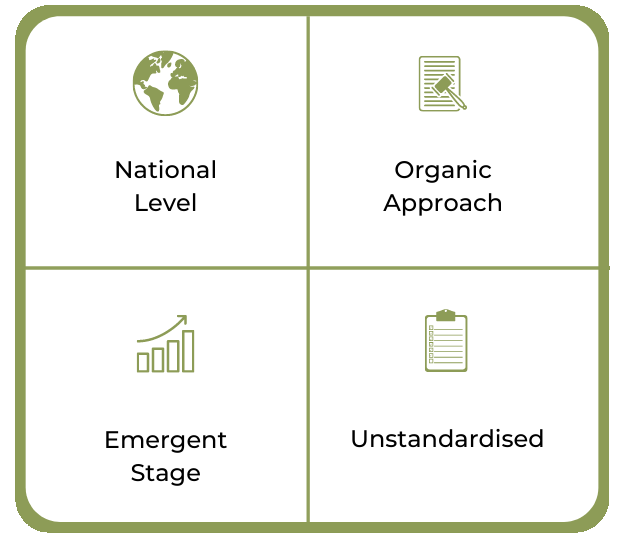

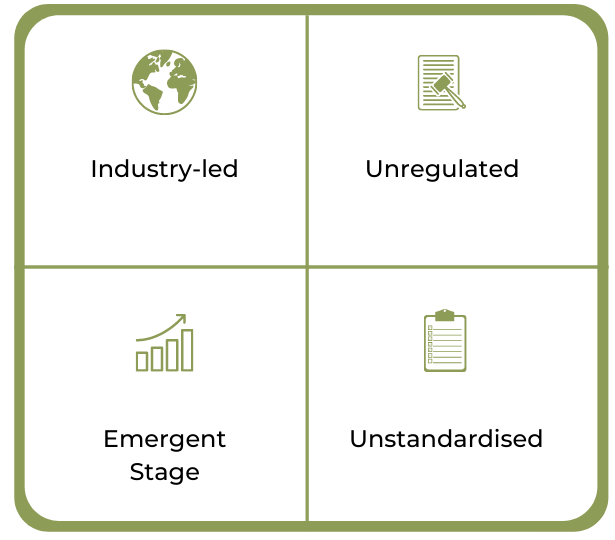

Since the launch of the second Payment Services Directive (PSD2) in Europe, there has been a sharp rise in the number of countries and banks adopting open banking initiatives. This interactive page details the regions, countries and institutions that are moving towards open banking and proposes a framework for categorising them based on four pillars:

Geographical Scope

Level of Regulation

Stage of Development

Degree of Standardisation

Click on any of the regions or countries below to see what initiatives have been introduced there.

Last Update: 6 September 2022

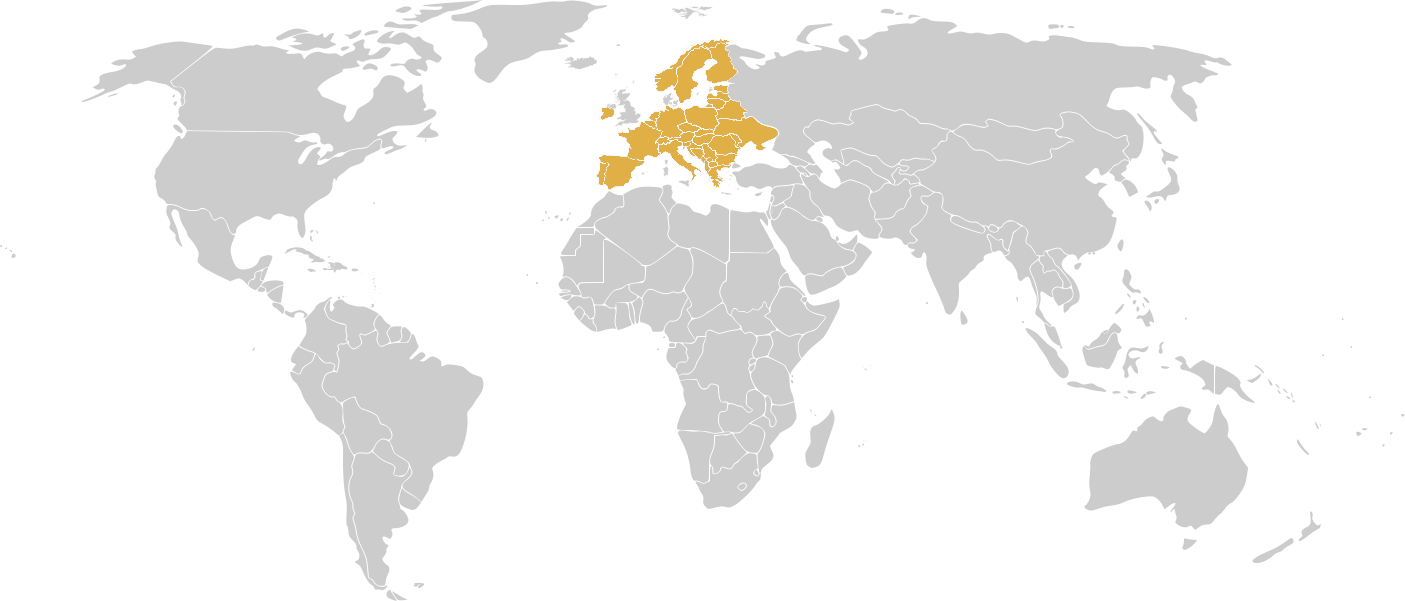

Europe

The European Union

The United Kingdom

Russia

Asia Pacific

Australia

China

Hong Kong

Japan

Malaysia

New Zealand

Singapore

South Korea

Latin America

Argentina

Brazil

Colombia

Mexico

Africa

Kenya

Nigeria

Rwanda

South Africa

The Middle East

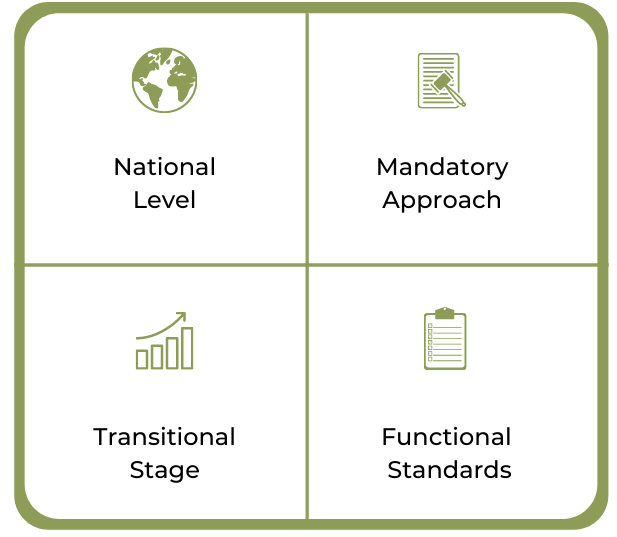

Bahrain

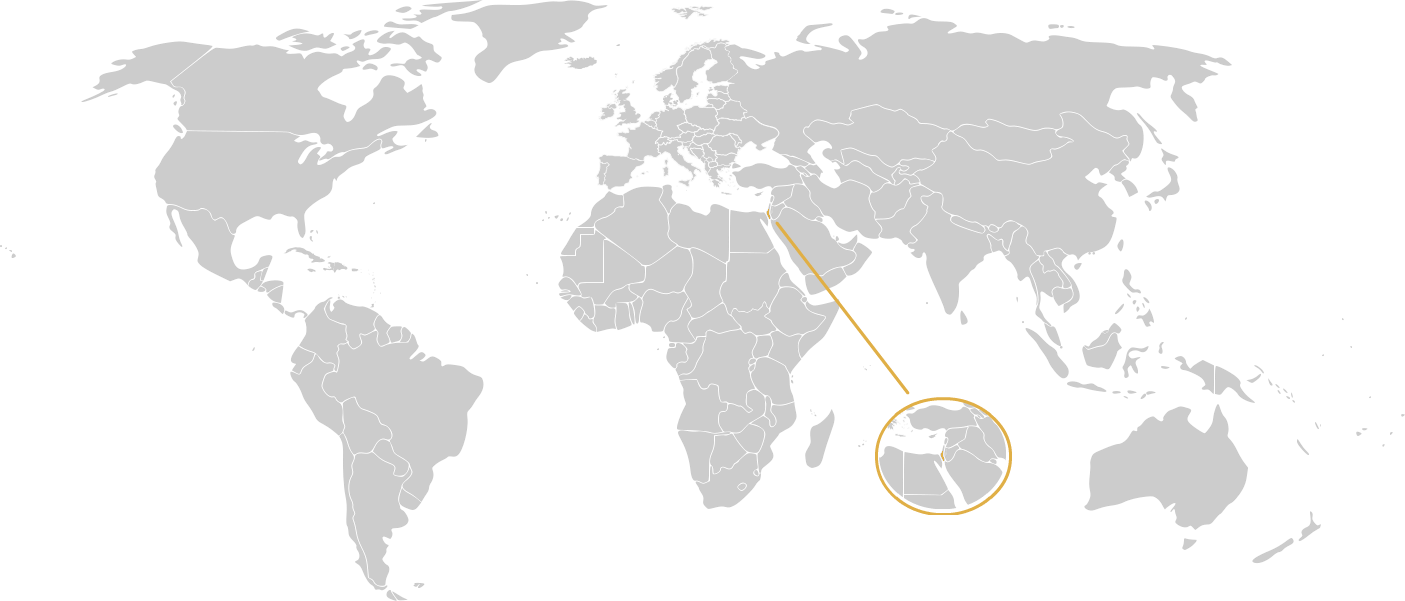

Egypt

Israel

Qatar

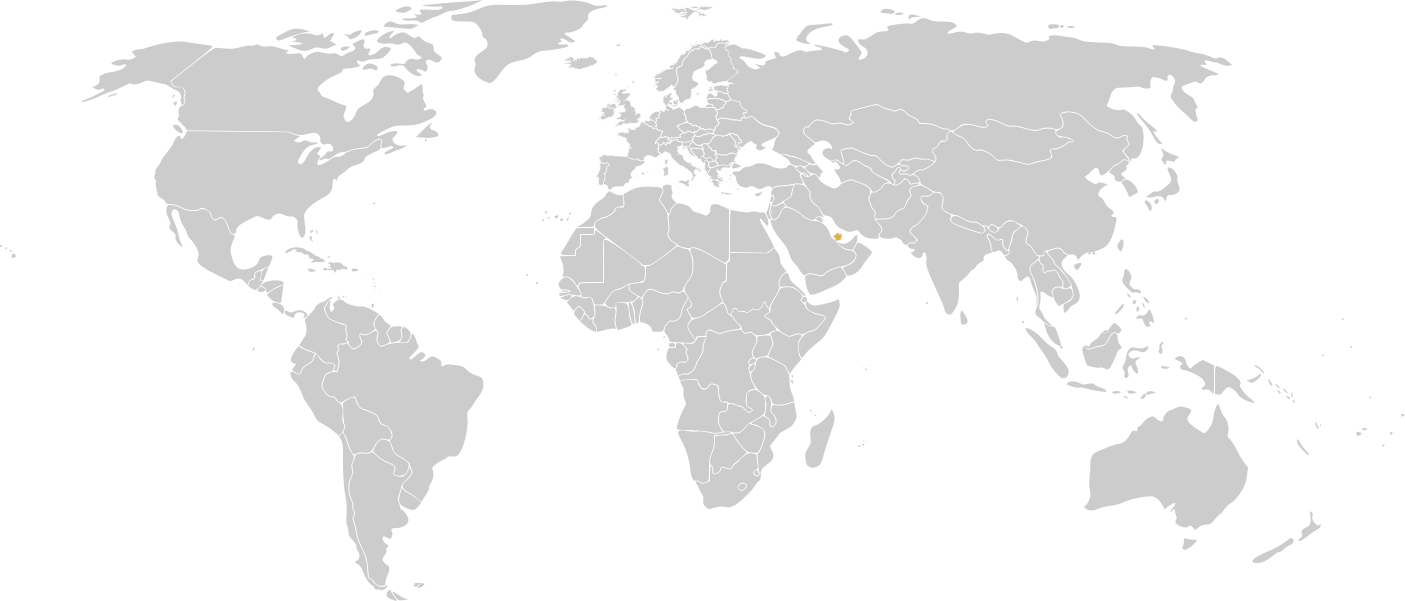

Saudi Arabia

Turkey

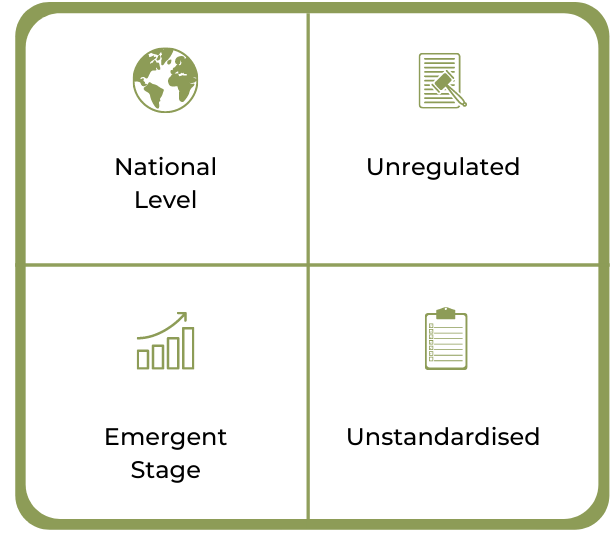

UAE

Global Outlook

The European Union

PSD2, which stands for the Second Payment Services Directive, was introduced by the European Union with the aim to create a more innovative payments market, regulate new players and protect customers online.

Key to this is the necessity for banks to open up their APIs and customer data to new Third Party Providers (TPPs) entering the market. First passed in 2015, the EU has struggled to fully adopt the regulation with big setbacks around Strong Customer Authentication pushing out the deadline for implementation to December 2020.

In 2022, the EU commenced their review of the Second Payment Service Providers Directive (PSD2) to analyse the current state of Open Banking in Europe, the impacts of the directive, as well as to identify what the barriers are to a more open financial system in the region.

The United Kingdom

In 2016, The UK Competitions and Market Authority (CMA) introduced their own national Open Banking initiative which builds on its PSD2 obligations and mandates that the nine leading banks in the country (CMA9) need to implement a predefined and standard API.

Unlike PSD2, it is a set of technical specifications and it does not leave the details up to the market to

decide. Leading banks like Barclays, Llyods and HSBC have enabled users to view financial information from their other bank accounts within their respective mobile banking apps.

The Financial Conduct Authority (FCA) are now looking to launch “Open Finance” which would extend to other financial products including mortgages and investments. In November 2021, FCA scrapped the 90 day re-authentication requirement to remove friction and make Open Banking easier to use.

Russia

The Central Bank of Russia (CBR) approved the first recommendatory standards for Open Banking in October 2020. They include API standards for account information, payment initiation as well as information security standards.

However, it is taking an organic approach to implementation, and financial institutions in the country are still not obligated to provide access to customers’ data via open APIs.

Singapore

The Monetary Authority of Singapore (MAS) has been encouraging banks to adopt APIs since 2016 with the development of a financial industry API playbook.

In December 2020, MAS launched the Singapore Financial Data Exchange (SGFinDex). SGFinDex is the world’s first public-private open banking initiative with a digital infrastructure that taps into the national digital identity system, SingPass.

It allows users to access and review personal financial information, such as loans, transactions, investments and even CPF, from across government agencies and private-sector organisations. SGFinDex brings together financial data for customers to give them a clear understanding of their finances and a holistic financial overview.

Hong Kong

The Hong Kong Monetary Authority (HKMA) has been promoting but not enforcing the adoption of Open Banking standards on the island with the aim of improving customers everyday banking lives since 2017.

Named the Open API framework for the Hong Kong Banking sector, these guidelines encourage banks to implement various API functions in a four-phase approach. Following the successful implementation of Phases I and II of the Open API Framework in January and October 2019 respectively, the HKMA announced the implementation plan for Phases III (Account information) and IV (Transactions) of the Open API Framework in May 2021.

The HKMA will oversee and facilitate the process, enabling the Hong Kong Association of Banks (HKAB) to develop a set of standards covering key areas of customer experience and authentication, technical and data standards, information security, and operations.

Japan

In May 2017, the central Bank of Japan (BOJ) amended the Japanese Banking Act to include a regulatory framework which mandated that banks must provide open APIs by 2020 to encourage innovation in a predominantly cash-based economy.

Since then a number of leading banks in the country, including MUFG, Mizuho and Fukuoka have developed and launched API platforms. However, progress has stalled as banks and fintechs are struggling to reach agreements because of the high fees fintechs are being asked to pay the banks for access to client data.

China

China has quickly become a stand-out nation when it comes to digital banking. With lightning fast development of banking technology, most banks in the country are leveraging APIs to provide their products and services to customers.

To date this has all happened in the absence of regulation, however, China’s financial authority announced in early 2020 their plans to release regulation in order to securely support the growth of the API ecosystem in the country.

Malaysia

Malaysia’s central bank, Bank Negara Malaysia (BNM), established the Financial Technology Enabler Group in June 2016 to promote innovations in the fintech sector.

In 2017 the BNM established an Open API Implementation Group to develop standards and to review regulations. In 2019, the BNM released a Policy document which provides guidance on the development and publication of open APIs. This document encourages financial institutions to adopt the Open Banking API specifications but does not mandate it.

South Korea

The Financial Services Commission (FSC), South Korea’s financial regulator announced plans to overhaul the country’s current financial regulatory framework and introduce new initiatives that are focused on embracing flexibility and scalability in financial services.

To promote the development and use of contactless financial services, the FSC began allowing savings banks and credit card companies to provide Open Banking services in the first half of 2021, which will be followed by financial investment businesses.

The government also said it will allow more account types to be eligible to sign up for Open Banking and to connect Open Banking with other digital finance infrastructures.

In December 2021, the FSC kicked off a pilot phase of MyData, a government-led programme aimed at giving users the ability to manage their personal financial data from different financial institutions on one platform. If successful, it will result in the development of a one-stop platform that offers analysis, financial advise and account transfer services all from the same place.

Australia

In 2018, the Australian Federal Government announced their plans to introduce Consumer Data Right (CDR) legislation which would give consumers the right to safely access and manage their data.

Four of the leading banks in the region, namely Commonwealth, NAB, Westpac and ANZ, went live with Open Banking in July 2020 and all non-major banks were mandated to follow on the one-year anniversary that we recently celebrated. Unfortunately, the majority of banks failed to come to the party by July 2021.

To date, there is only one way to go to market with Open Banking, which is to become an Accredited Data Recipient (ADR) which allows full access to CDR data across banking and other sectors.

In March 2022, Australia’s Treasury Department commenced consultation on expanding its flagship competition policy, the Consumer Data Right (CDR), to include Open Finance.

New Zealand

Payments NZ, the bank-owned governing body of New Zealand’s core payment systems, debuted a set of standards in

March 2019 to provide a standardised API framework and direction for banks and third-party vendors interested in Open Banking opportunities.

The API service was launched as the Payments NZ API Centre. An updated version of these standards and an updated sandbox was released in 2020.

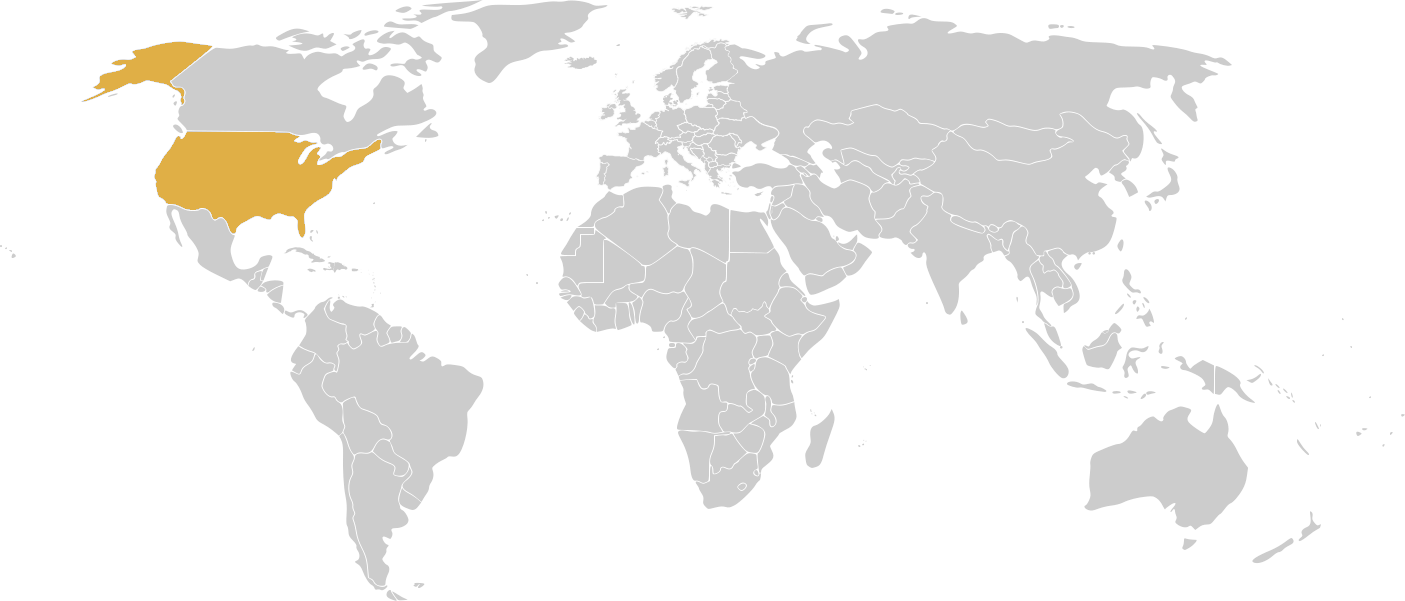

The USA

While regulators in the US have chosen not to implement Open Banking standards at a national level, President Biden issued an Executive Order in July 2021 that hints at initiating the process of regulating Open Finance in the US.

Currently, The Financial Services Information Sharing and Analysis Centre (FS-ISAC) Data Aggregation Work Group which comprises of banks, fintechs and financial aggregators, who are building and sharing API technical recommendations called the “Durable Data API”. Banks such as Wells Fargo, Citi and Bank of America have adopted these standards.

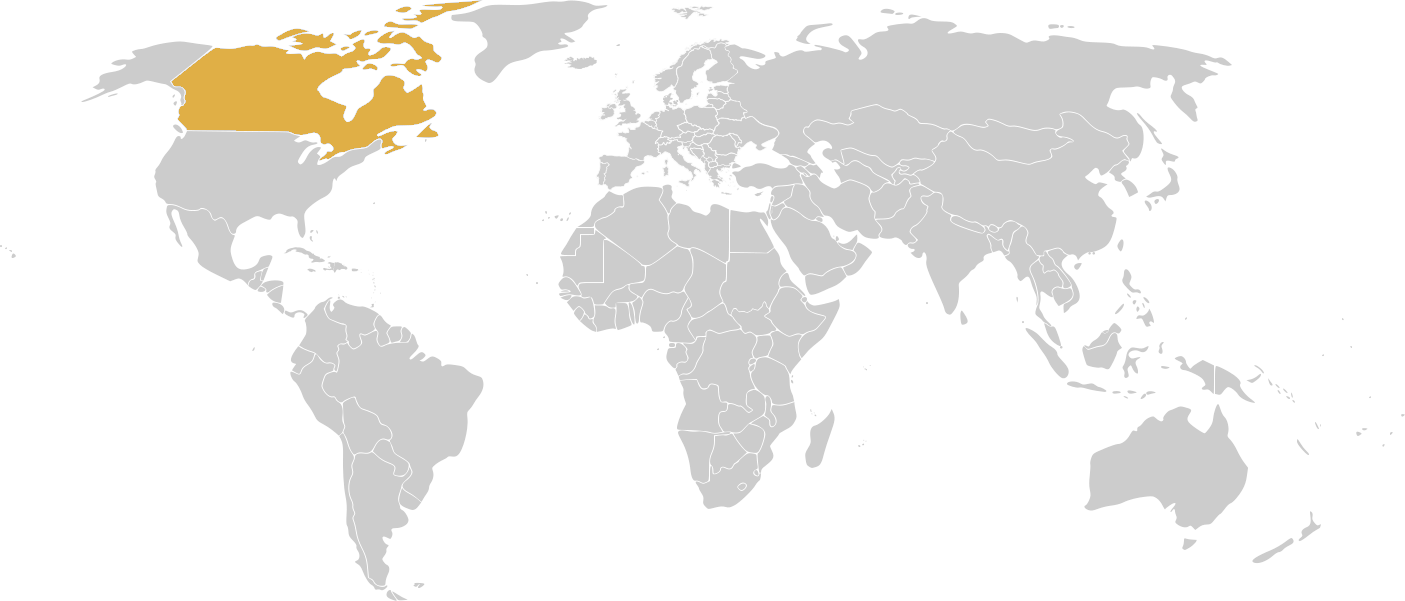

Canada

Since 2018, the Ministry of Finance’s Open Banking Advisory Committee has been conducting research into Open Banking standards. Split into multiple phases, the 2nd phase has been delayed due to the COVID-19 pandemic.

In July 2021, FinConect, a US based technology company signed an agreement with FICANEX, Canada’s largest surcharge free ATM network to deliver an Open Banking platform to Canadian credit unions and banking clients.

Mexico

In June 2020, the Comisión Nacional Bancaria y de Valores (CNBV) published the first Open Banking guidelines, which establishes the expectation to exchange public, aggregated and transactional data across all financial entities. Financial institutions have 12 months to comply, and should be exchanging data and information by June 2021.

According to the latest update in June 2021, over 2,200 financial entities in Mexico have already implemented APIs to exchange account data with third parties. Following this, the expectation will expand to include aggregated and transactional data.

The CNBV is expected to publish new guidelines related to the sharing of transactional information from customers’ accounts and credit. However, it remains to be seen when the deadlines for this data sharing will be compulsory.

Argentina

The Argentinian government has yet to introduce any regulation around Open Banking, however industry players in the market have taken steps to build standards for the country.

Open Banking Argentina, a nongovernment body, has developed open banking standards with the aim of creating an interactive and innovative financial ecosystem in the country.

Brazil

In 2019, The Central Bank of Brazil (BACEN) published an Open Banking directive which outlined the objectives, scope and strategy for implementation of Open Banking in the country.

The regulation was initially launched in early 2020 and is expected to be rolled out over four phases. Banks are forecasted to implement Open Banking by November 2020 and be fully operational by October 2021 with all major financial institutions mandated to adopt the regulation within the phased timeline.

In late 2021, the final stage of the Open Banking initiative in Brazil took off, thus marking the shift into Open Finance, thus rendering the entire financial footprint of individuals with data such as mortgages, savings, pensions, insurance, and credit to be opened up to trusted third-party APIs upon consumer consent.

Colombia

The Colombian government is introducing Open Banking to the country on a voluntary basis and will be conducting a series of workshops with financial sector players to advance a regulatory framework.

Open Banking is expected to promote innovation in the financial services sector, ramp up the use of APIs and enable third-party developers and fintech companies to build applications and services.

The Unidad de Proyección Normativa y Estudios de Regulación Financiera (URF), a governmental unit in Colombia for regulatory projection and financial regulation studies are running a series of public-private sector events to help define and refine the Government’s planned approach.

The Open Banking initiative complements other URF initiatives like broader modernisation of the country’s payment system and the overarching aim is to create a regulatory framework that encourages digitalisation and innovation across financial services in the country.

Rwanda

In response to its growing fintech market, the National Bank of Rwanda (NBR) has released regulation around Open Banking and plans to release detailed standards in the near future.

The Open Banking regulation in Rwanda addresses data sharing and data portability with a view to encouraging innovation, efficiency, new products development and new players.

Kenya

The Central Bank of Kenya (CBK) has released a draft document outlining a five-year digitalisation plan to modernise the country’s domestic payment landscape. Titled Kenya National Payments System Vision and Strategy 2021 – 2025, it outlines a commitment to establishing a regulatory landscape to enhance innovation and embracing Open Banking and APIs, among other key areas of focus.

In the document, the CBK says it will work to define standards for API development and mandate data portability with hopes that more options and innovative solutions will be made available for Kenya-based users to choose from.

Nigeria

The Central Bank of Nigeria (CNB) issued a regulatory framework for Open Banking in Nigeria in February 2021 to establish a regulatory environment for the development of a more innovative and customer-centric financial services.

Prior to the inception of the framework, banks operated in a closed ecosystem, with exclusivity of access to their own data, and no data sharing. The framework will enable financial institutions and services in Nigeria to drive much needed innovation in the sector.

South Africa

In contrast to other countries in the region, South Africa is a highly regulated market.

While no regulation has been introduced around Open Banking to date, it is expected that when regulation is introduced it will be comprehensive and mandatory. For now, until regulation is released, the market has found its own way to introduce standards with leading banks in the region such as Nedbank launching APIs that are aligned to the UK’s Open Banking technical standards.

Bahrain

The Central Bank of Bahrain (CBB) issued draft regulations on Open Banking in 2018 thus taking the lead in introducing regulations in the region.

The initiative was a major step towards transforming the financial services industry by enabling greater transparency and inclusivity through open data.

In response to the CBB’s mandates, The National Bank of Bahrain (NBB), partnered with Tarabut Gateway, an Open

Banking system provider, to develop and launch a common platform that banks in Bahrain could access in order to comply with Open Banking regulation and make use of standardised APIs.

In November 2020, further strengthening the ecosystem, the CBB released a second phase of regulations called the Bahrain Open Banking Framework (BOBF), setting a precedent for how Open Banking is deployed across the Middle East and North Africa.

Egypt

In 2019, the Egyptian the government passed a data protection law with a specific focus on customer consent that will support the implementation of Open Banking in the country.

The Egyptian Banks Company, which is a venture co-owned by the Central Bank, the Ministry of Finance and several national banks collectively are currently working on formal regulations around open banking to incorporate into the central bank’s regulatory sandbox and support its Fintech Egypt innovation hub.

Israel

In 2019, the Bank of Israel published its Open Banking draft guidelines and invited interested relevant stakeholders to comment or make suggestions.

The regulation which will be rolled out in a phased approach, requires that banks initially allow for the secure sharing of bank account and transaction data. Following that, over a period of two years, access to additional customer information including customer’s credit, loans, deposits, savings and securities portfolios will need to be shared with third parties.

Qatar

Qatar National Bank (QNB) announced the launch of their Open Banking platform for their users and also a wider audience including partners and emerging fintechs in Qatar in June 2022.

Spearheading the Open Banking movement in Qatar, QNB’s platform will enable customers, fintechs and third-party providers gain access to its core financial services, securely share customer data and facilitate payments between organisations. The QNB issued its first digital services license in September 2022.

Saudi Arabia

In line with the strategic priorities set for Saudi Vision 2030, the Saudi Central Bank (SAMA) launched the first version of their Open Data Platform in December 2021. In 2022, the Arab National Bank followed suit and upgraded their existing B2B services using API technology to meet the future needs of Open Banking in Saudi Arabia.

Financial inclusion, innovation and economic development are cornerstones of the Saudi Vision 2030, which is driving the change to financial ecosystems in the Kingdom.

There are three phases to the Open Banking Initiative, beginning with a design phase in the first half of 2021. The market implementation phase started mid 2022, and banks are now required to open their APIs.

Turkey

In 2019, the Central Bank of the Republic of Turkey (CBRT) announced it would be fully complying with the European Union’s PSD2 regulation.

Although not a member of the European Union, and therefore not required to comply with the regulation, the CBRT has chosen to adopt it after it did the same with its predecessor PSD1, five years ago.

Turkish financial institutions adopted and implemented PSD2 standards on the 1st of January 2020, granting access to customer data to third-party providers.

The UAE

In July 2021, the Central Bank of the United Arab Emirates (CBUAE) announced the Retail Payment Services and Card Schemes Regulation, the fourth of its kind to lay the groundwork in the UAE for a new era of digital payments.

The regulation initiates a licensing infrastructure for payment service providers operating – or wishing to provide – one or more of nine payment services or payment card schemes in the UAE, which includes Open Banking enabling services such as payment initiation, and payment account information services.

A one-year transitional period has been given to existing payment service providers and card schemes to obtain the relevant license from CBUAE.