Upgrade customer experiences with cutting-edge PFM solutions

Make customer’s lives easier and drive real engagement with personal financial management.

LET'S GET STARTED

Make customer’s lives easier and drive real engagement with personal financial management.

LET'S GET STARTEDDeliver engaging experiences

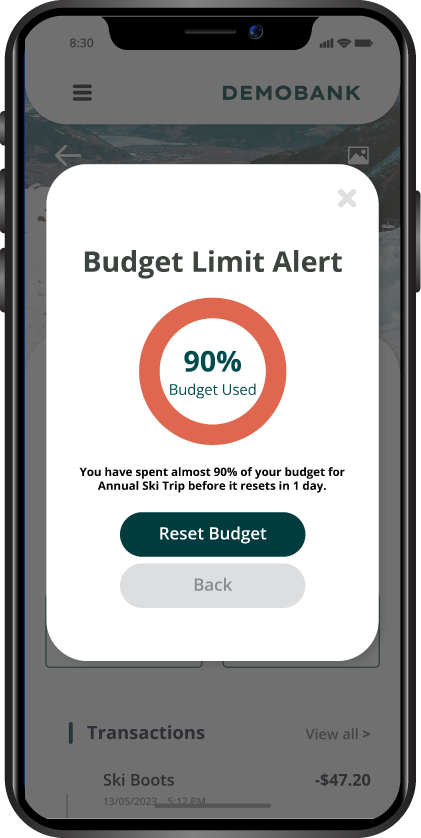

Enhance digital engagement by offering users real-time insights and actionable recommendations, fostering a proactive approach to financial management.

Help customers to manage their money

Provide personalised budgeting, expense tracking, and savings goal features, to encourage users to actively participate in their financial journey.

Improve retention and loyalty

Helping users achieve their financial goals and offering tailored recommendations, strengthens loyalty and increases retention rates over time.

The range of PFM use cases that can be implemented using the Moneythor engine is vast. Here are three of the most popular use cases we implement for financial institutions.

For today’s customers, transaction categorisation and a clear overview of income and expenses are expected. At Moneythor, we provide the capability to deliver this seamlessly within digital channels to drive increased engagement

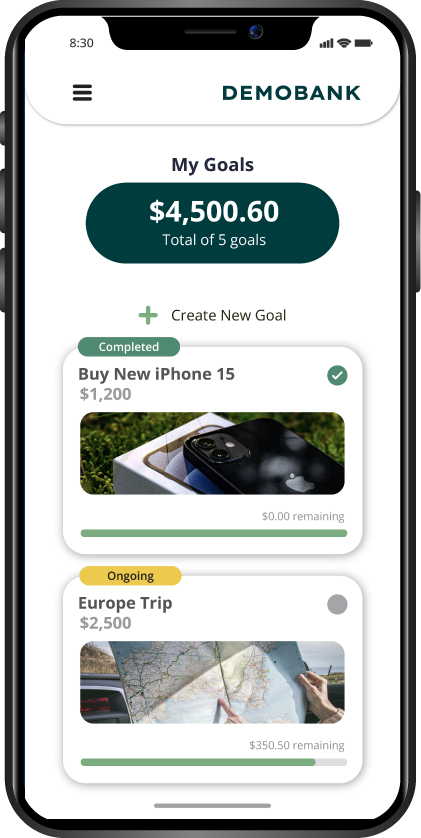

Helping users establish and maintain savings goals is important for banks in fostering a strong deposit foundation. We provide straightforward methods for setting up and overseeing goals, while also gently nudging users along their journey to ensure continuity and sustained engagement.

Smart and predictive PFM use cases like predictive cash flow forecasting and subscription bill calculations offer valuable insights for customers and can drive higher levels of loyalty.

At Moneythor we have experience working with incumbents and new digital upstarts to help them deliver hyper-personalised money management tips and tools.

We have a library of over 150 use cases that our clients can seamlessly integrate into their digital banking offering. Additionally, our studio allows for the creation of completely customisable use cases. Examples of use cases include money management nudges, budgets, savings goals, predictive forecasts, financial literacy material and more.

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields