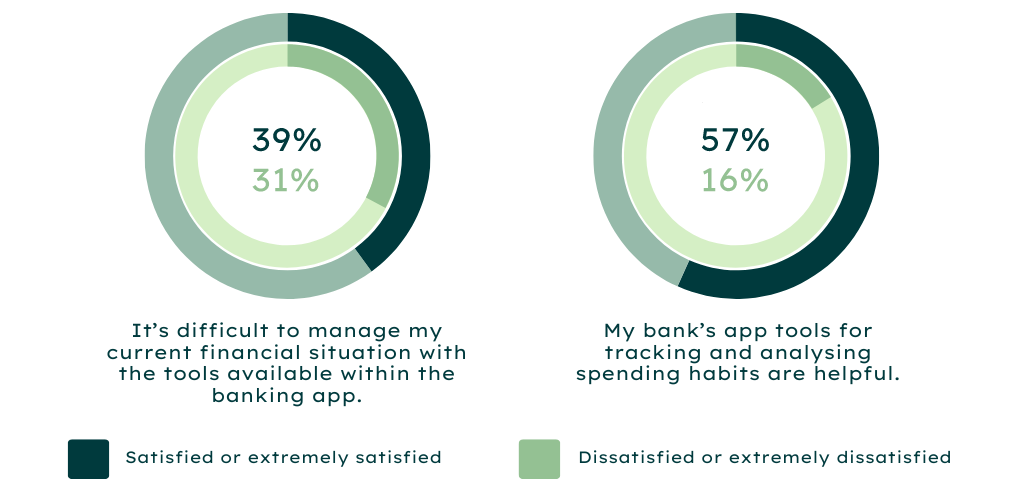

Byte-Sized Banking: The App Experience

2024 Report

Based on insights from 1,300 digital banking customers in Australia and New Zealand, find out how seamless user experiences and proactive tools are shaping the future of banking apps in our latest report prepared in partnership with Experian.