Elevate Customer Engagement and Experience

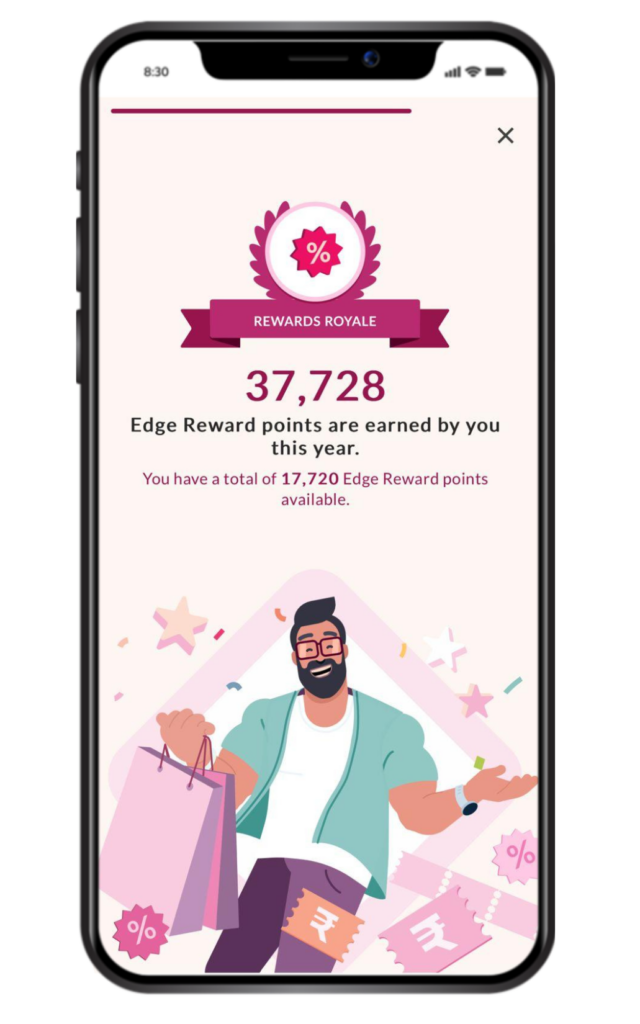

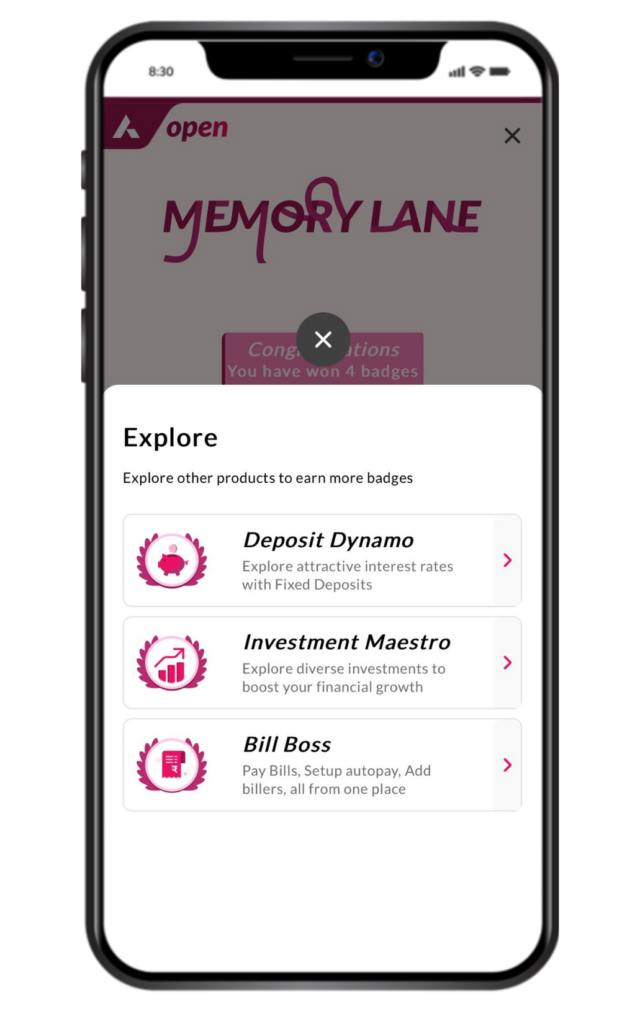

Through Personalised and Gamified Journeys

For many in retail banking, the challenge is acquiring and retaining customers while enhancing the digital experience and ROI from new customer acquisition. Fintech Futures, in partnership with Moneythor, conducted a comprehensive survey, gathering insights from professionals across various domains in the financial sector.

Key findings from the report:

To access the full survey report and discover valuable insights and strategies, download your copy now.

Powered by real-time data analytics and behavioural science, the Moneythor Solution delivers un-matched, data-driven and personalised experiences to customers across all digital banking channels. Examples of these include money management nudges, budgets, savings goals, predictive forecasts, financial literacy material, referral campaigns, gamified experiences, loyalty programs and more.

Find out More

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields