Acquire, activate and engage customers fast.

Outperform your competitors with a sophisticated member-get-member, referral management programme.

Moneythor Referral Management goes beyond simple welcome offer rewards.

With personalised, multi-step milestones and interactive, gamified experiences, we enable you to create a referral management programme that fast-tracks new customer growth and fosters active customers.

Designed specifically for financial institutions, the refer-a-friend experience is embedded within your digital banking platform.

Create unique experiences for your customers with Moneythor.

Our clients report significant benefits: increased revenue, improved customer satisfaction, more engaged and active customers, and reduced new customer acquisition costs.

7x

Lower cost of acquisition compared to average CPA

2.3x

More transactions amongst activated customers

70%

New customers acquired by referrals

12%

Market share growth (in 1 year)

Sophisticated functionalities, yet simple to use

Moneythor provides unparalleled flexibility. Build a finance referral programme based on world’s best practices, that is unique to your customers.

Why is referral management important?

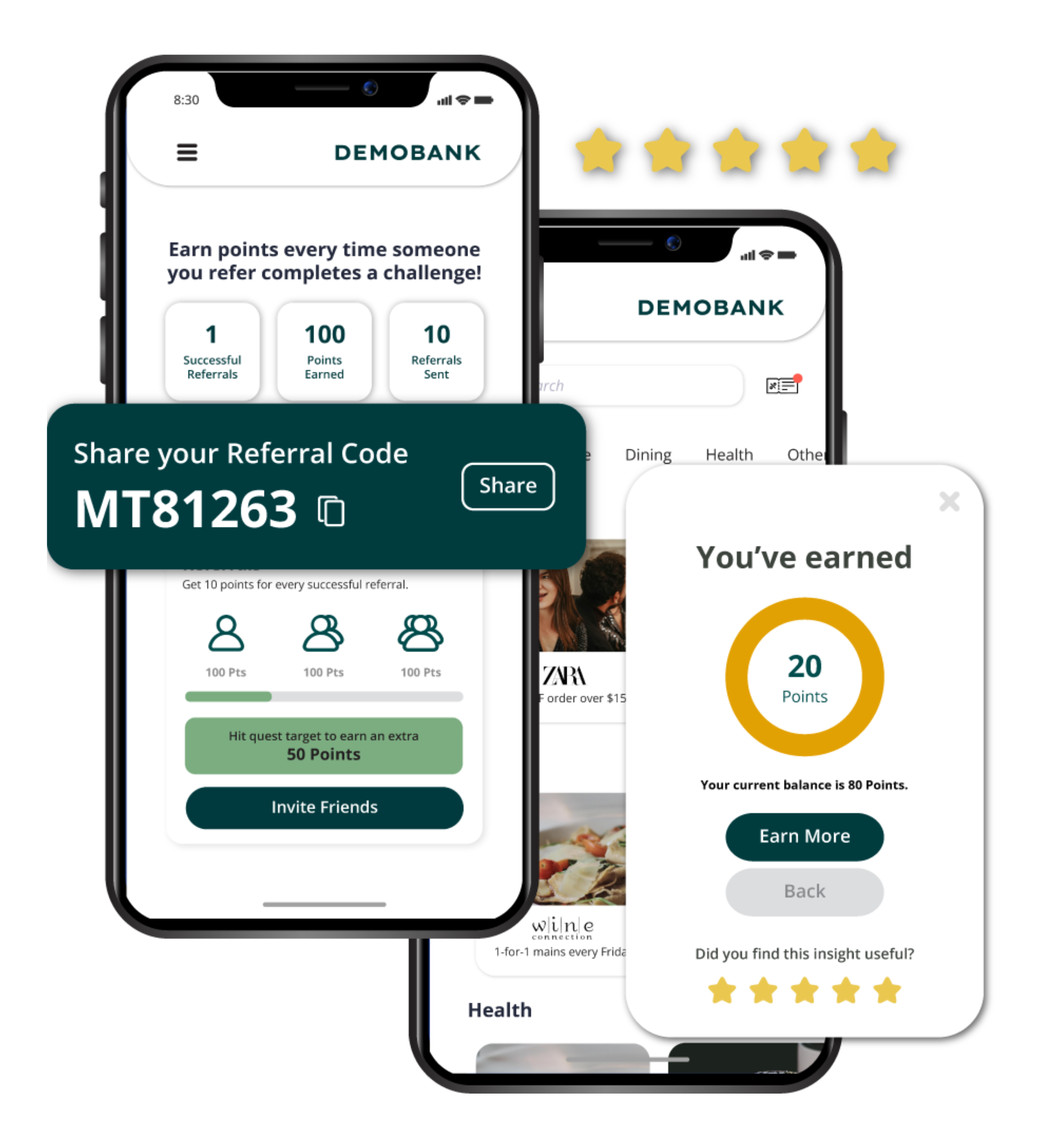

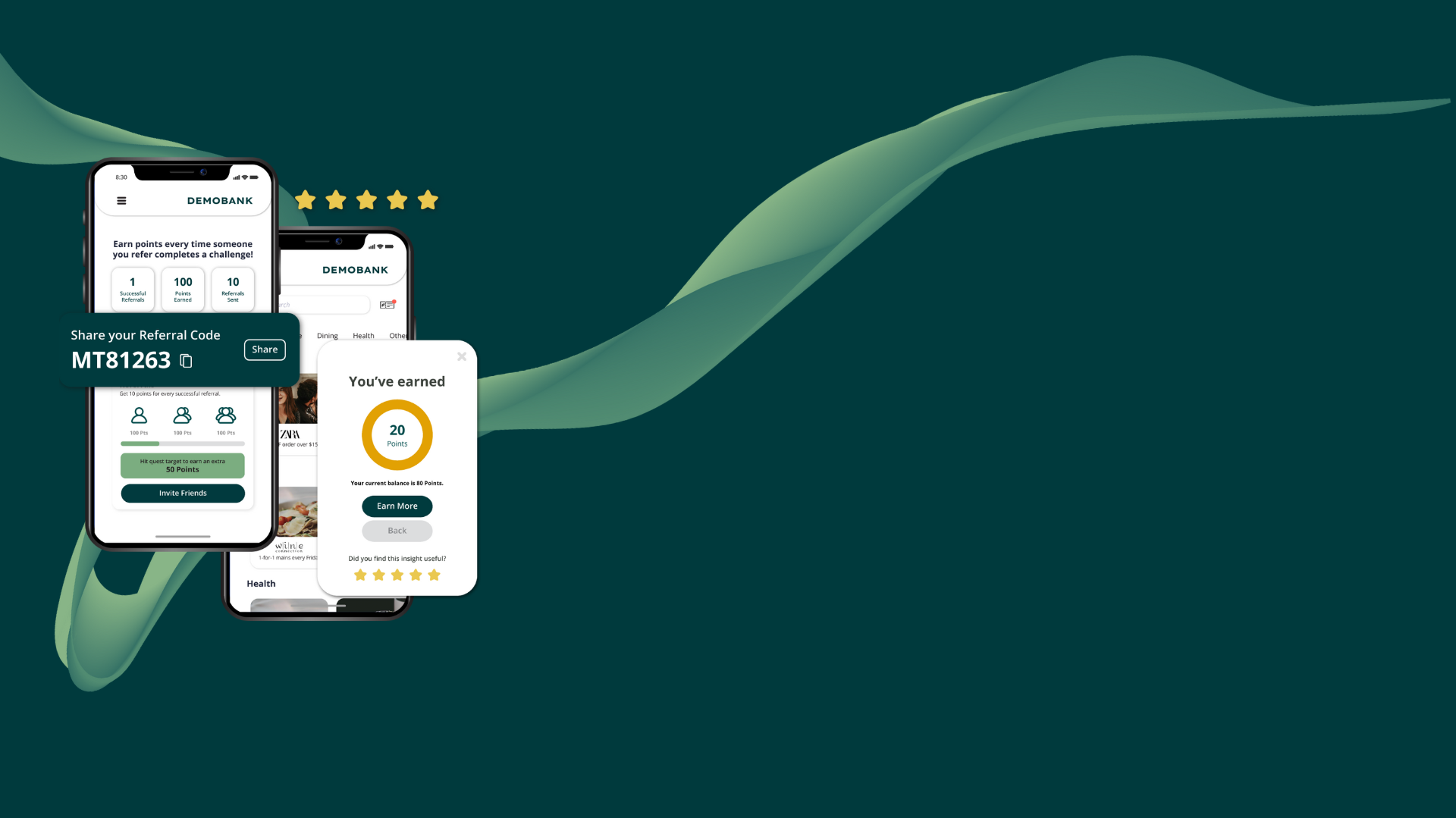

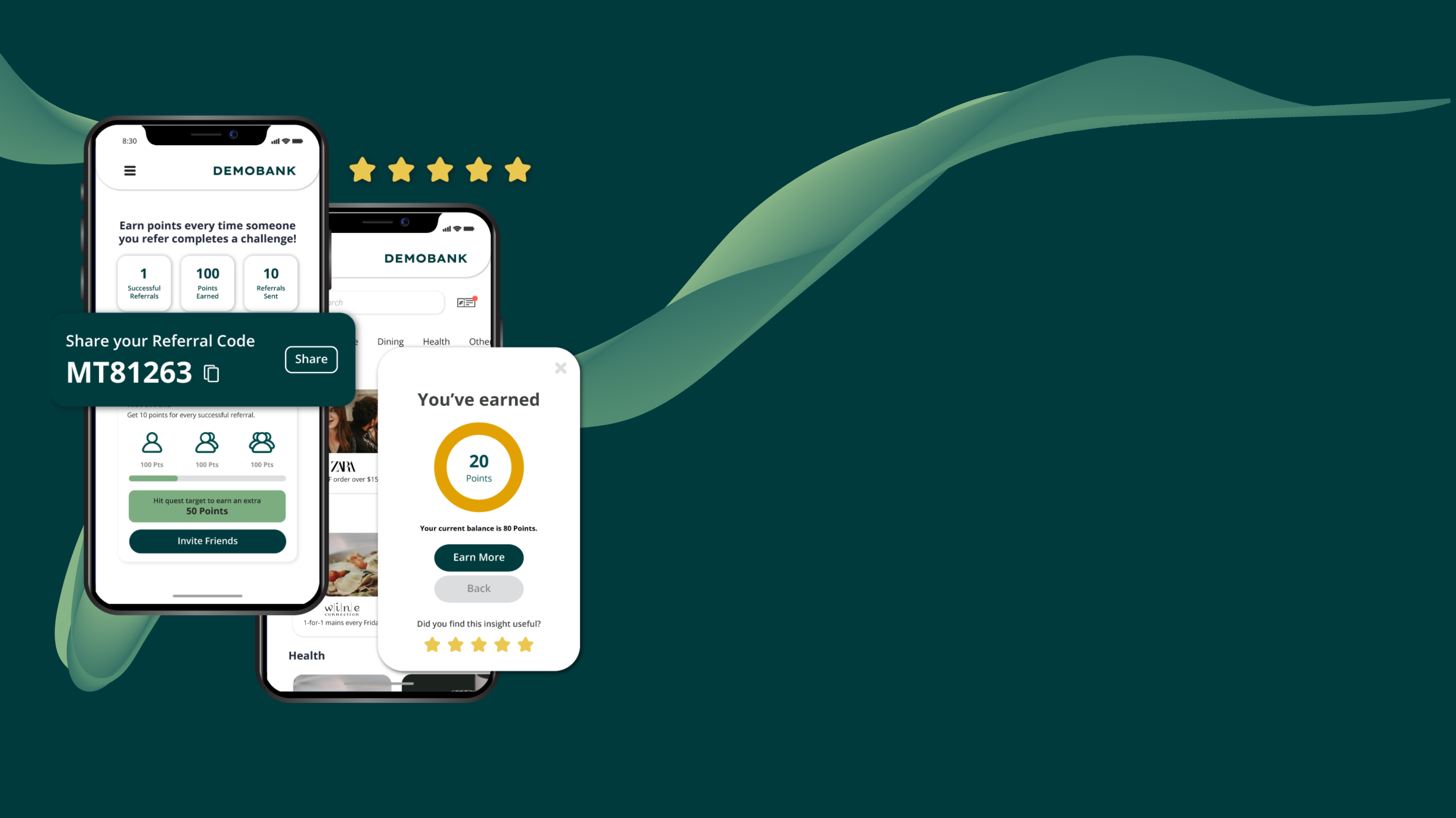

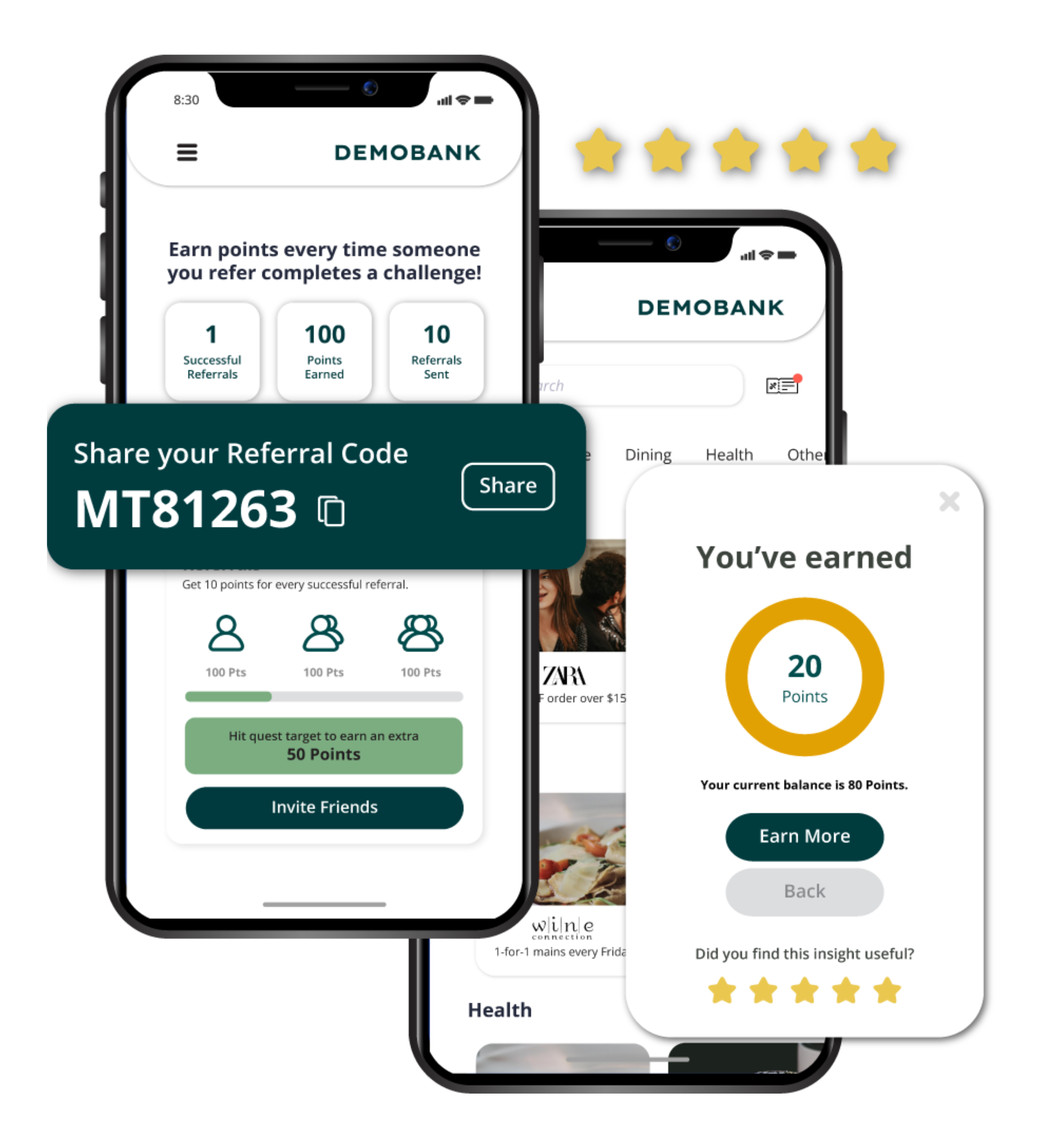

Easy to refer friends and family

Simple, one tap code sharing.

Seamless in-app integration, makes sharing simple.

Drives brand advocacy.

Easy share via email, social media, SMS, contact centre, in-branch, mobile app or online banking.

Leverage merchants, partners and influencers

Encourage your best customers and partners to be brand ambassadors.

Easily share unique codes or in bulk.

Reward with points, gifts, cashback, vouchers, etc

Multi-product referrals. Maintain long term customer engagement

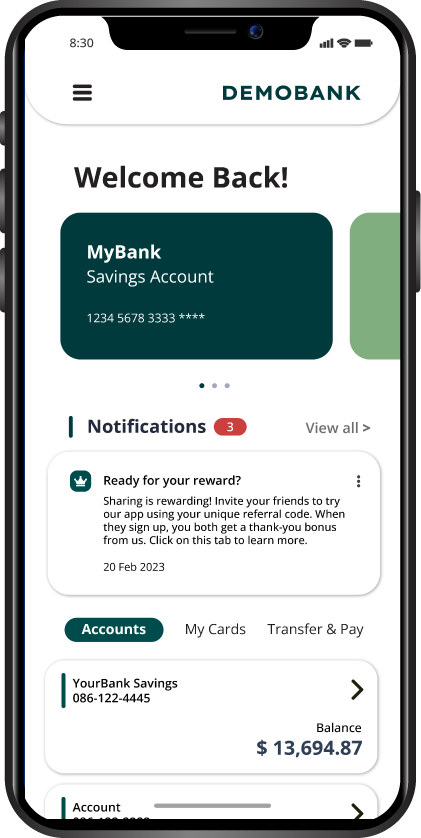

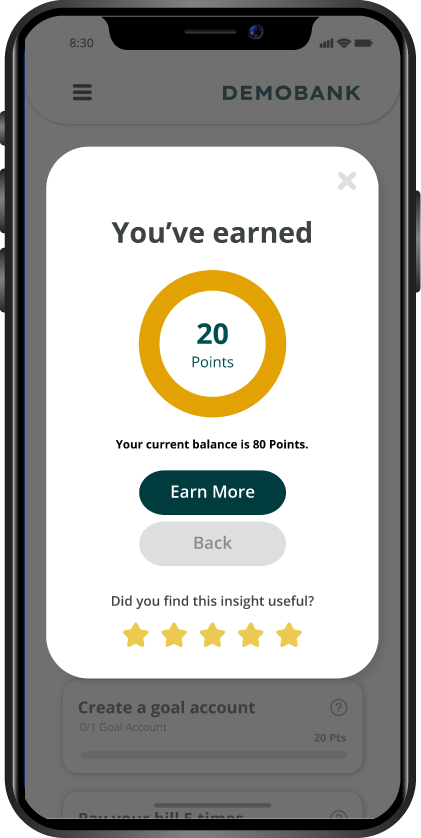

Seamlessly welcome and delight new-to-bank customers. Go beyond a simple welcome offer. Increase customer activity with Moneythor’s progressive rewards and multi-tiered, gamified incentives.

Activate customers and turn them into loyal supporters. Referral incentives to promote any product: savings, checking, loans, mortgages, credit cards, insurance.

Communicate seamlessly, before, during and after initial referral.

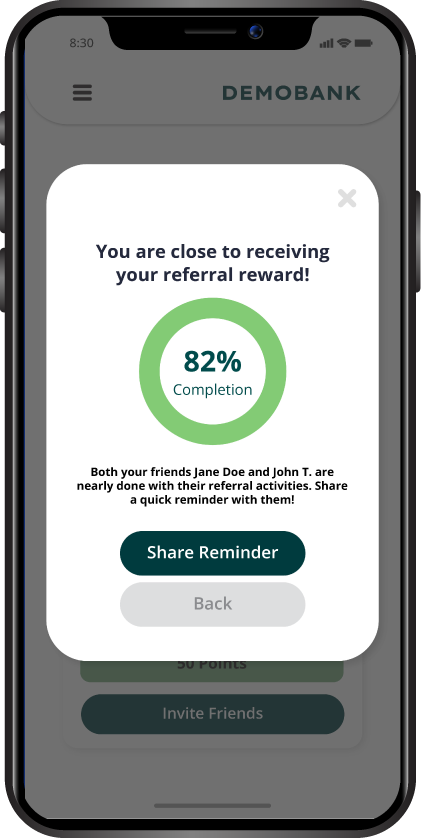

Referrer and referee incentivised to engage

Realtime nudges and incentives.

Personalised messages.

Prompts to take actions.

Progressive incentives.

Multi-step milestones.

Two-way rewards.

Automated, frictionless experience.

Read how implement successful referral programmes in banking.

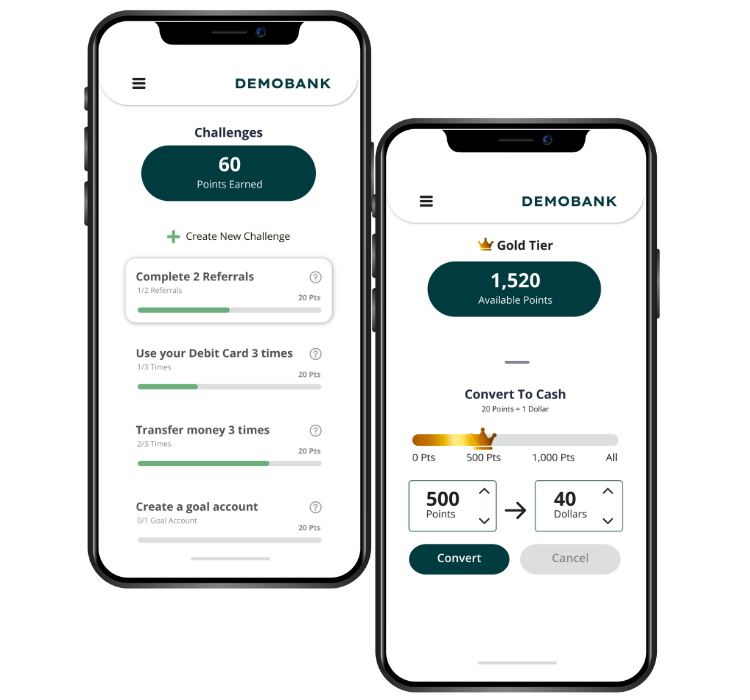

Customers can track progress towards award milestones

Dashboard.

Milestone tracker, progress updates.

Points, lucky draw, gifts, cashback balances.

Gamified experience drives campaign success

Challenges.

Chances to play.

Mini games.

Set goals and track progress.

Games homepage.

Leaderboard.

Data insights and behavioural science to drive personalisation at scale

Monitoring dashboard.

Data analysis, AI-driven insights to customise customer offers.

Easy integration, deployment and campaign management

API integration.

Integrates with existing digital banking channels (app, web, contact centre, in-branch…).

SaaS deployment shortens time to market.

Moneythor is an all-in-one personalisation engine specifically designed for financial services.

We help to turn your customers into a goldmine of loyal advocates who want to tell their friends and family about your products.

Referral management is one of our suite of personalisation solutions from Moneythor.

Moneythor Referral Management SaaS application embeds seamlessly into your banking app or website. No separate sites or apps, no copy and pasting of referral codes required. It’s so easy to use, it drives customer growth.

Our mission is to transform the digital bank-customer relationship and create meaningful interactions throughout the customer lifecycle.

Clients report:

- Increased new customer acquisition

- Lower customer acquisition costs

- More activated new customers

- Increased customer lifetime value, increasing revenue

Yes. We offer an AI-powered, full suite of personalisation solutions to enrich the whole customer banking lifecycle. Our customer activation solutions help to increase account activation and deposits, increase card activation and usage. Our client engagement solutions help to drive engagement, retention and referrals.

Moneythor provides a complete suite of personalisation solutions to drive measurable business results.

Configurable – Moneythor’s unmatched flexibility enables financial institutions to manage changing customer needs

Quick to market – Deliver personalised experience to market quickly and efficiently: Lower acquisition costs

Personalisation – next level personalisation goes beyond out-of-the-box solutions, we can help you to tailor programmes to the individual

Real-time data – allows real time customer interactions

A complete solution for the whole customer journey

Highly experienced team of banking, tech and behavioural science experts

Moneythor was founded in 2013 by three digital banking veterans who saw the opportunity to modernise the customer banking experience with new, exciting and personalised experiences.

We started with a best-in-class categorisation engine for banks to turn their data into personalised insights, recommendations and nudges, today we offer a full suite of personalisation solutions for the whole customer journey.

We have offices in Asia, Australia, Middle East, Europe, Africa and the USA.

Our goal is to bring better financial experiences to customers throughout the customer lifecycle.

Clients love Moneythor

“With support from Moneythor, we introduced real-time reward redemption, driving our ground breaking referral program and achieving cost of acquisition that is lower than market averages. By offering instant FairPrice E-vouchers for successful referrals, we revolutionised customer engagement, with nearly 70% of new customers referred by friends or family”

Nitin Bhargava, Chief Data & Analytics Officer, Trust Bank.