Moneythor’s SaaS Solution

Multiple deployment options available to cater to the diverse needs and preferences of our clients.

GET IN TOUCH

Multiple deployment options available to cater to the diverse needs and preferences of our clients.

GET IN TOUCHMoneythor’s SaaS model allows for easy accessibility, scalability and straight-forward maintenance with limited dependency on internal IT services. Moneythor holds certifications for ISO 27001 and SOC2 Type 2, ensuring robust ongoing security standards.

Moneythor offers an on-premise deployment option for clients that need to fully manage their infrastructure in-house. In this case, the Moneythor solution is installed on a client’s own physical or virtualised servers, located within its data centre.

Technically similar to the on-premise mode, the Moneythor solution can also be hosted and configured on the client’s own private cloud platform. Clients can use the third-party cloud technology and PaaS provider of their choice.

The Moneythor SaaS solution allows for quicker time to market and simplified set-up.

With Moneythor’s SaaS solution, features can be easily scaled according to the bank’s growing needs.

Moneythor’s SaaS solution can reduce physical infrastructure costs and lower the dependency on internal resources such as IT.

Read about some considerations when choosing a SaaS deployment.

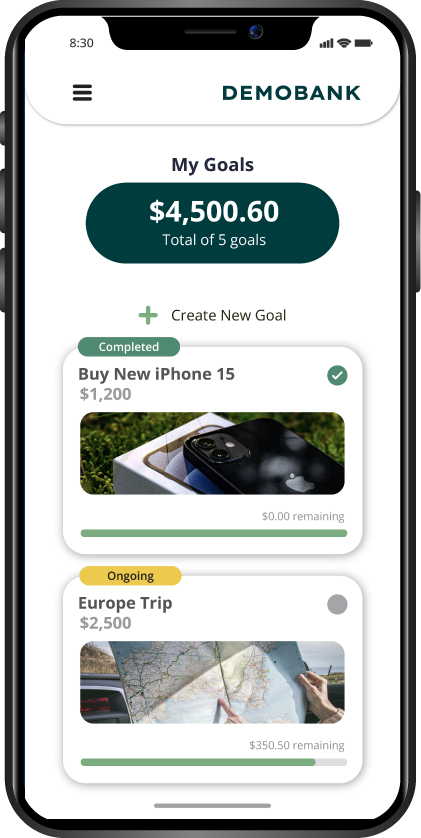

Assist customers in tracking their savings progress relative to their goals, providing them with real-time updates and insights to keep them motivated and on track. Additionally, facilitate automatic contributions to their savings based on predefined criteria, streamlining the process, and ensuring consistent progress towards their objectives.

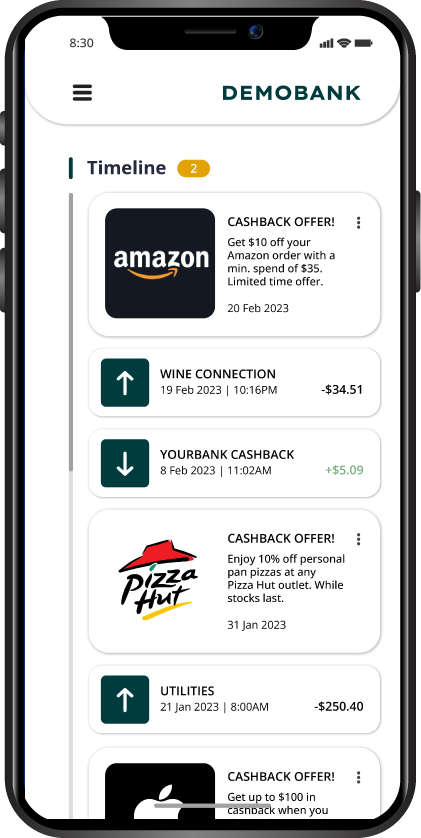

Manage everything in one configurable and seamless loyalty platform including card-linked & merchant offers, points and reward redemption and gamified campaigns.

Set up and manage full referral management campaigns within the Moneythor studio. Provide a comprehensive view of referrals in action, progress updates and referral rewards.

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields