The cost-of-living has continued to increase in many parts of the world. Factors such as inflation, housing costs, and healthcare expenses pose challenges for individuals trying to achieve financial stability. In light of this, financial wellbeing and financial education have become more critical than ever to mitigate these pressures.

According to the World Economic Forum,

1 in 4 people in developed countries are struggling financially. In the UK, the cost-of-living crisis is impacting millions of people, with 1 in 7 unable to afford to eat every day.

Statistics like these showcase the depth at which the current cost-of-living crisis is affecting people and their day-to-day lives.

With continuously raising inflation, central banks’ rate hikes and supply-demand crunches as a side effect of the Russian invasion of Ukraine, the world economy is facing a range of new challenges that will likely take time to recover from.

While we know that economic markets are cyclical and we expect rates of inflation and interest rates to level out in the future, the exact path to this future is unknown and will likely be paved with financial difficulties and stress for most people.

The question remains; how can banks support their customers during these difficult times and what role does financial wellbeing play in helping the most vulnerable amongst us?

In this guide, we will dive deeper into the current state of personal finances, suggest steps and programs that retail banks should consider launching in order to help their customers navigate these tough times ,and finally we will look to the future and how focusing on financial wellbeing now can build up financial resilience and stability for the future.

What we will cover in this guide

The current state of personal finance

The cost-of-living crisis refers to the situation where the expenses necessary for basic needs and daily living have risen significantly, outpacing the growth of incomes and making it increasingly difficult for individuals and households to afford a decent standard of living. A number of factors are driving the crisis forward and have led to a change in the financial circumstances of the average person. These factors include:

Rising inflation rates

Rising inflation rates have led to increased prices for essential goods and services, such as housing, food and healthcare. These higher costs naturally put a strain on budgets as purchasing power diminishes and people struggle to afford basic goods and necessities.

Cost of housing

In many global markets, the cost of housing has increased exponentially as a result of supply and demand issues within the construction industry and increasing interest rates on mortgages. High rents and increased mortgage payments consume a significant portion of people’s income, leaving less money for other expenses and savings.

Increased cost of borrowing

As interest rates rise, the monthly payments on loans such as mortgages, personal loans, or credit cards increase. This can put additional strain on individual’s budgets leaving them with less disposable income to cover other expenses or save for the future.

As a result of rising inflation rates, housing price hikes and increased cost of borrowing, the purchasing power of the average person has diminished greatly leading to financial insecurity and financial stress. People have reduced capacity to deal with financial emergencies and unexpected expenses as they struggle to maintain a financial buffer.

This in turn is having a significant toll on people’s mental and emotional wellbeing. Stress, anxiety and feelings of helplessness are common as individuals constantly worry about meeting their financial obligations and providing for their families.

Addressing the cost-of-living crisis requires a multi-faceted approach. Banks should look to provide enhanced financial education and management tools to empower individuals to make informed financial decisions and mitigate the impact of rising costs.

Why is financial wellbeing important during a cost-of-living crisis?

What is financial wellbeing?

Financial wellbeing refers to the state of an individual’s overall financial health and stability. It encompasses the ability to meet one’s financial obligations, effectively manage money, and make informed financial decisions that align with personal goals and values.

What role does it play during the cost-of-living crisis?

Financial wellbeing during the cost-of-living crisis provides individuals with the tools, knowledge and confidence to navigate financial challenges effectively. It empowers individuals to make informed decisions, build financial resilience, and optimise their financial resources to weather the current crisis and improve their long-term financial stability.

What are some of the ways financial wellbeing can help people weather the crisis?

-

- It helps people manage their resources effectively.

- It enables individuals to develop and maintain realistic budgets based on their income and expenses.

- It provides individuals with knowledge about responsible borrowing and debt management.

- It equips individuals with the tools to evaluate financial products, services, and investments.

- It encourages people to proactively seek financial advice and access support.

How can banks support customers during the crisis?

Banks can support their customers during the cost-of-living crisis by offering short-term financial relief. They should also offer guidance, and resources to not only help individuals and families navigate challenging economic circumstances but to improve their long-term financial wellbeing.

Here are some of the ways banks can help customers navigate the crisis and improve financial wellbeing through their digital channels:

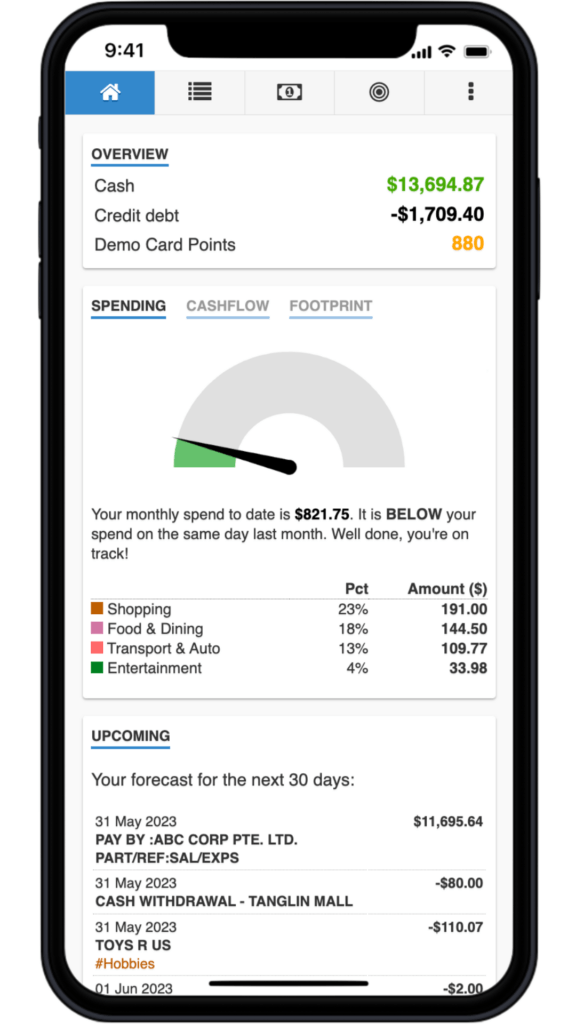

Personalised financial management

By providing personalised insights and recommendations to customers, banks can provide them with a clearer picture of their current financial standing and situation.

Using easy to read transaction feeds, real-time notifications, and clear spending overviews, banks can make the daunting task of understanding spending behaviours and financial routines simple.

Banks can also use Open Banking or even Open Finance and data aggregation to provide their customers with a holistic view of their finances across multiple sources.

The ability to understand finances is the first step in building a plan of action to get through the uncertain times of the cost-of-living crisis..

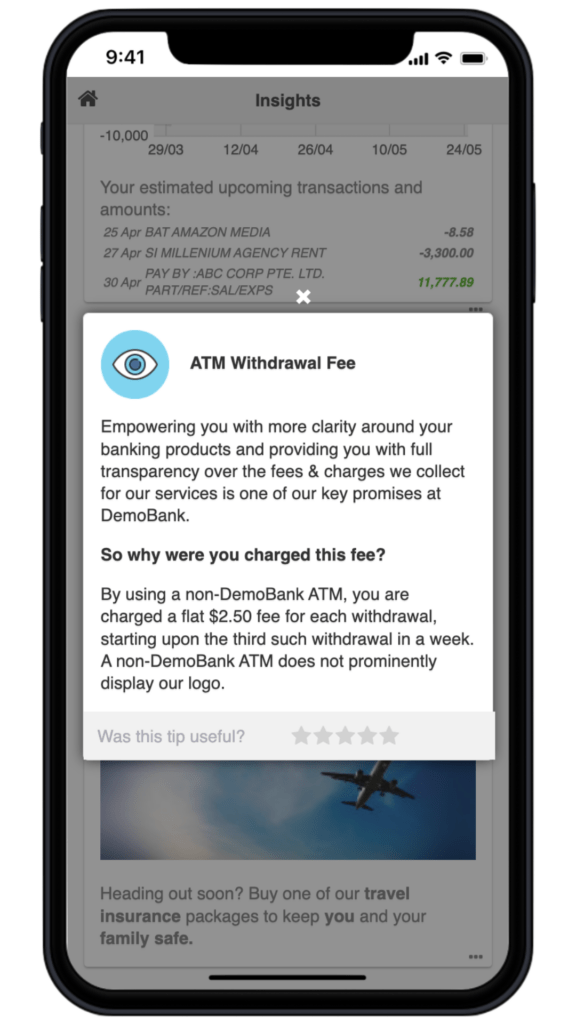

Financial literacy & education

Providing customers with the tools and understanding of financial concepts, such as budgeting, saving, investing, debt management, and understanding financial products and services, enables individuals to make informed decisions and avoid financial pitfalls.

Banks can provide this information through contextual bitesize notifications and recommendations within banking apps to help customers build up their financial literacy overtime.

Additionally, banks can look to use gamification techniques to provide deeply engaging financial education that will not only give customers the knowledge to get through this current crisis, but set them up for future financial success also.

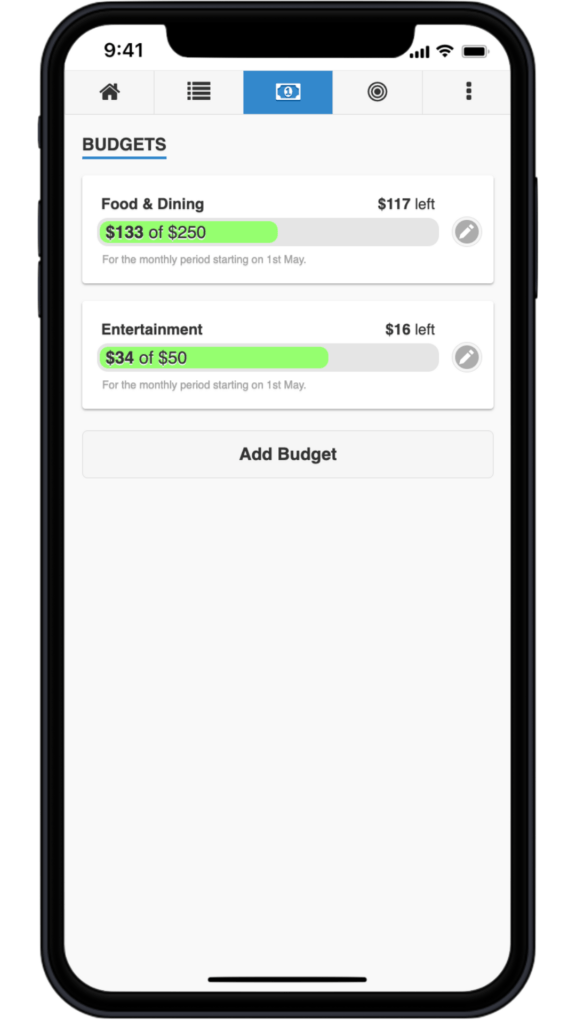

Financial planning tools

Banks can help customers to develop and follow realistic and manageable budgets based on personalised insights and previous spending behaviours. By providing Personal Financial Management (PFM) tools including budgeting and intelligent savings in app, customers have one place where they can track income and expenses and ensure that their spending aligns with their financial goals and priorities.

By using real-time data and insights, banks can help their customers to stay on track with their budgets and savings goals to ensure long-term financial success.

Predictive financial management

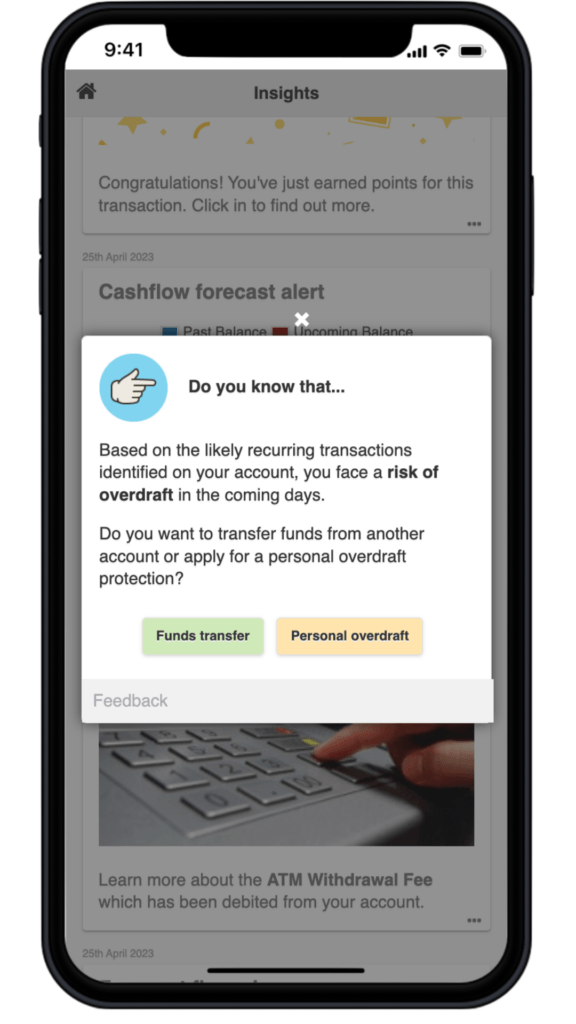

Predictive financial management tools like financial forecasts or alerts allow individuals to project their income and expenses over a specific period. It helps them to allocate their resources effectively, prioritse essential expenses, and identify areas where they can make adjustments or cut back to cope with the increased cost-of-living.

Financial forecasts provide a forward-looking perspective, enabling individuals to anticipate potential financial challenges and take proactive measures before they get into difficulty.

Using historical transaction data, banks can easily provide these predictive insights to customers to prevent their financial situation from deteriorating.

Conclusion

Addressing the cost-of-living crisis requires a multi-faceted approach, including measures to control inflation, promote wage growth, and provide affordable housing options. Banks alone cannot “fix” the crisis. However, they can provide financial relief options to support customers in the short and enhanced financial education for long-term financial stability and growth.

Financial wellbeing and education during a cost-of-living crisis provide people with the tools, knowledge, and confidence to navigate financial challenges effectively. It empowers them to make informed decisions, build financial resilience, and optimise their financial resources to weather the crisis and improve their financial situation.

By making financial management tools and insights available through digital channels, banks can become an invaluable source of support to customers during the cost-of-living crisis.

At Moneythor, we offer a range of features that are proven to help customers improve their financial wellbeing and literacy overtime.

Download Financial Wellbeing in a Cost-Of-Living Crisis Guide

"*" indicates required fields